Axis Bank, established in 1993, has emerged as one of India’s leading private sector banks, offering a comprehensive range of financial services, including retail banking, corporate banking, and investment banking.

As of 2024, the bank employs approximately 90,000 individuals and operates an extensive network of branches across the country.

Axis Bank, one of India’s largest private sector banks, has shown consistent growth driven by its diversified banking model, tech-led initiatives, and strategic acquisitions (e.g. Citibank India Consumer Business). The bank’s performance is aligned with its GPS (Growth, Profitability, Sustainability) strategy

Understanding share price targets is crucial for informed investment decisions as it helps investors gauge the potential future value of a stock based on comprehensive analysis.

These targets offer insights into a company’s growth prospects, financial health, and market conditions. By aligning investments with these projections, investors can better strategize their entry and exit points, manage risks, and set realistic expectations for their portfolio’s returns.

Key Highlights from Recent Financial Reports:

- Consolidated Profit for FY23: ₹23,172 crore (excluding exceptional items).

- Consolidated Return on Equity (ROE): 18.84%.

- CASA (Current Account Savings Account) growth: 21% YoY.

- Net Interest Margin (NIM): 4.02%, indicating strong core banking profitability.

- Acquired 2.4 million affluent Citi customers, boosting premium customer segments .

Current Market Overview

- Current Price: ₹1,139.15 (as of the latest close)

- Recent Movement: The stock declined by ₹19.00, or -1.64%, at the last market close.

- 1-Year Performance: The stock has gained approximately 10.59% over the past year.

- Market Capitalization: ₹3.58 trillion INR.

- P/E Ratio: 12.90 (TTM), indicating moderate valuation compared to its peers.

- Upcoming Earnings Date: January 22, 2024. Estimated EPS is 19.81 INR.

- 52-Week High: ₹1,205

- 52-Week Low: ₹930

Axis Bank’s focus on digital transformation, expanding retail lending, and improving asset quality suggests a positive long-term outlook. The upcoming earnings report in January 2024 will be a key event for market sentiment.

Axis Bank Stock Price Target 2024-2033

| Year | Share Price Target |

| Axis Bank Share Price Target 2024 | ₹1,200 |

| Axis Bank Share Price Target 2025 | ₹1,320 |

| Axis Bank Share Price Target 2026 | ₹1,470 |

| Axis Bank Share Price Target 2027 | ₹1,640 |

| Axis Bank Share Price Target 2028 | ₹1,820 |

| Axis Bank Share Price Target 2029 | ₹2,020 |

| Axis Bank Share Price Target 2030 | ₹2,250 |

| Axis Bank Share Price Target 2031 | ₹2,500 |

| Axis Bank Share Price Target 2032 | ₹2,780 |

| Axis Bank Share Price Target 2033 | ₹3,080 |

Axis Bank Share Price Target 2025

Axis Bank Share Price Target 2025 is ₹1,320.

Axis Bank plans to continue expanding its retail loan book and SME lending, which offer higher margins. The focus on cost optimization and efficient capital utilisation is likely to boost profitability further.

With the digital banking segment growing, the bank expects to capture a larger market share, supporting a price increase.

Additionally, the completion of Citibank India Consumer Business integration is expected to yield significant synergies.

Axis Bank Share Price Target 2027

Axis Bank Share Price Target 2027 is ₹1,640.

The expansion of the bank’s branch network and digital channels will contribute to increased revenue. The premiumization strategy, focusing on affluent customers, is expected to result in higher fee-based income.

The bank’s efficient risk management practices and improved asset quality (Gross NPA projected at below 2%) will enhance investor confidence, driving stock price growth.

Axis Bank Share Price Target 2030

Axis Bank Share Price Target 2030 is ₹2,250.

By 2030, the bank’s strategic focus on becoming a “Digital First” bank will likely pay off, with significant market share gains in digital transactions.

The bank’s expansion into new financial services (e.g., wealth management, insurance) will diversify its income streams and reduce reliance on traditional lending.

The expected economic growth in India will provide a favorable environment for banking sector expansion, supporting a higher stock price.

Shareholding Pattern Analysis

The shareholding pattern of Axis Bank over the last few years shows significant changes across different shareholder categories, including promoters, Foreign Institutional Investors (FIIs), Domestic Institutional Investors (DIIs), and the general public. Here is a detailed analysis:

| Matric | Value (Sept 2024) |

| Promoters | 8.29% |

| FIIs | 51.78% |

| DIIs | 33.21% |

| Public | 6.71% |

| No. of Shareholders | 8,28,629 |

Promoter Shareholding

The promoter shareholding has been decreasing, starting at 9.71% in December 2021 and falling to 8.29% in September 2024.

A decline in promoter shareholding is often viewed negatively as it might indicate a reduction in promoter confidence.

However, in this case, it could also be due to regulatory changes or strategic divestments to increase liquidity and public participation.

Foreign Institutional Investors (FIIs)

The FII shareholding has shown a strong upward trend, increasing from 47.44% in December 2021 to a peak of 54.68% in December 2023 before slightly decreasing to 51.78% in September 2024.

The significant increase in FII holdings indicates strong foreign investor confidence in Axis Bank. This is a positive sign as FIIs typically look for quality investments with good growth potential, and their involvement can lead to higher stock liquidity and market credibility.

Domestic Institutional Investors (DIIs)

DII shareholding has fluctuated but remains robust, starting at 30.21% in December 2021, peaking at 32.26% in September 2022, and then stabilizing around 33.21% in September 2024.

The consistent involvement of DIIs reflects strong domestic confidence in Axis Bank’s growth strategy and financial performance.

High DII participation can be a stabilizing factor for the stock, especially during periods of market volatility.

Public Shareholding

Public shareholding has decreased significantly from 12.64% in December 2021 to 6.71% in September 2024.

The decline in public shareholding suggests that a larger portion of the stock is now held by institutional investors (FIIs and DIIs).

While this could indicate reduced retail investor participation, it may also point towards increased institutional interest, which typically brings stability and long-term investment perspectives.

Number of Shareholders

The number of shareholders has seen a decline from 8.52 lakh in December 2021 to a low of 7.69 lakh in September 2023, followed by a recovery to 8.28 lakh in September 2024.

The fluctuation in the number of shareholders could indicate changes in investor sentiment. The recent recovery suggests renewed interest, possibly driven by improved financial performance or strategic initiatives by the bank.

Is Axis Bank a Good Long-Term Investment?

Based on the shareholding pattern and the involvement of institutional investors:

1.Institutional Confidence:

The increasing FII and DII shareholding indicates strong institutional confidence in Axis Bank’s long-term growth prospects.

Institutional investors generally conduct thorough due diligence, which adds credibility to the investment case.

2.Decreased Retail Participation:

The decline in public shareholding might be a concern for retail investors. However, it can also be seen as a positive shift towards a more stable investor base, reducing stock volatility.

3.Growth Potential:

Axis Bank has shown significant improvement in its financials, asset quality, and profitability in recent years, supported by digital transformation and expansion into retail and SME lending.

The current shareholding pattern suggests that Axis Bank is well-regarded by institutional investors, which is a positive indicator for long-term stability and growth.

With the bank’s strong focus on digital initiatives and improving asset quality, it appears to be a good candidate for long-term investment, especially for those seeking exposure to a leading private sector bank with robust growth prospects.

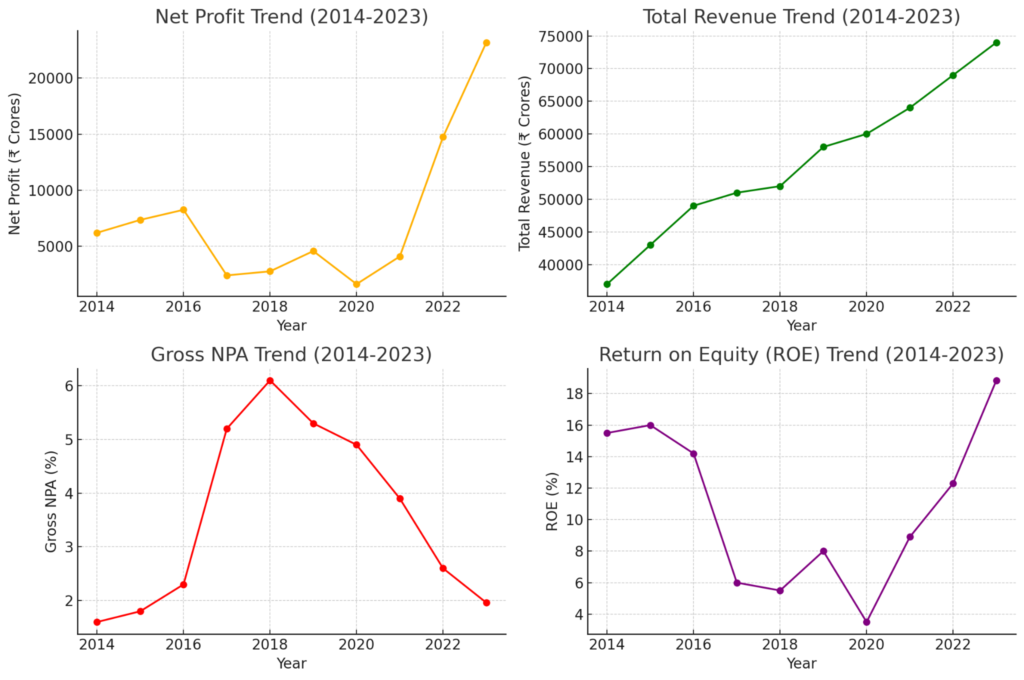

Last 10 years Profit-Loss Statement Analysis

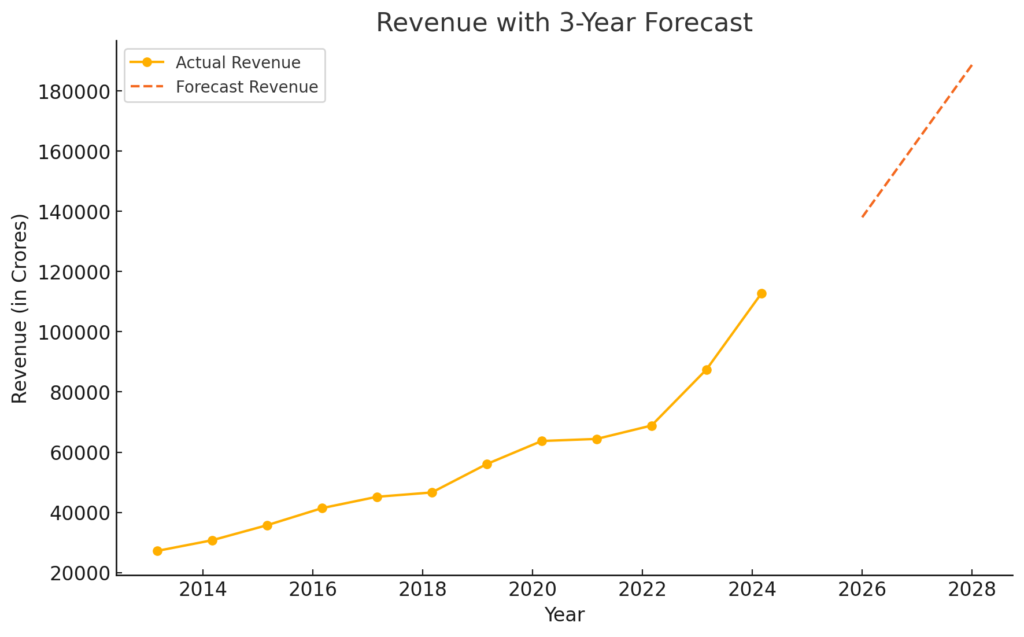

1. Revenue Growth

Trend: Revenue increased significantly from ₹27,202 crore in March 2013 to ₹121,855 crore in the trailing twelve months (TTM).

Industry Comparison: The average revenue growth rate for private sector banks is around 10%-12% annually. Axis Bank’s growth trajectory aligns with or slightly outperforms the industry average, especially in the last few years.

Analysis: Strong revenue growth indicates effective loan book expansion, increased interest income, and higher fee-based income from digital and retail services.

2. Interest Income

Trend: Interest income grew from ₹17,513 crore in 2013 to ₹67,546 crore in TTM.

Industry Comparison: The growth in interest income is consistent with the industry trend, driven by loan portfolio expansion and better management of interest-earning assets.

Analysis: Axis Bank’s focus on retail and SME lending, as well as improved net interest margin (NIM), has contributed to this strong growth in interest income.

3. Expenses

Trend: Operating expenses increased from ₹8,538 crore in 2013 to ₹45,934 crore in TTM.

Industry Comparison: While the increase in expenses is significant, it is in line with the industry trend, given the rising costs of digital transformation, branch network expansion, and regulatory compliance.

Analysis: The bank’s increasing expenses are a concern but are mitigated by revenue growth. Efficient cost management and digital initiatives are critical areas for improvement.

4. Financing Profit and Margin

Trend: Financing profit has shown volatility, with losses reported during 2017-2020. It improved significantly to ₹8,376 crore in TTM.

Financing Margin: The financing margin dropped to negative levels during 2017-2020 but rebounded to 7% in TTM.

Industry Comparison: Industry averages for financing margins typically range from 3%-5%. Axis Bank’s recent improvement to 7% is a positive sign, indicating effective cost control and better loan pricing strategies.

Analysis: The volatility was due to increased provisioning for NPAs, but recent improvements reflect better asset quality and profitability.

5. Other Income

Trend: Other income, including fee-based income and trading gains, increased from ₹6,833 crore in 2013 to ₹28,117 crore in TTM.

Industry Comparison: Axis Bank’s growth in other income is strong, driven by increased customer transactions, wealth management services, and digital banking initiatives.

Analysis: The increase in other income is a positive sign, reflecting the bank’s diversified revenue streams beyond traditional interest income.

6. Depreciation

Trend: Depreciation costs have increased over the years, peaking at ₹13,146 crore in March 2023, before dropping to zero in TTM.

Analysis: The spike in depreciation may be attributed to investments in technology infrastructure and branch expansions. The recent drop to zero could indicate changes in asset valuation or accounting adjustments.

7. Profit Before Tax (PBT)

Trend: PBT showed significant fluctuations, dropping to ₹566 crore in 2017 but recovering strongly to ₹36,493 crore in TTM.

Industry Comparison: The recovery in PBT aligns well with industry performance, as most banks faced challenges during the NPA crisis and pandemic years but have since rebounded.

Analysis: The recovery in PBT reflects improved profitability, lower credit costs, and better asset quality management.

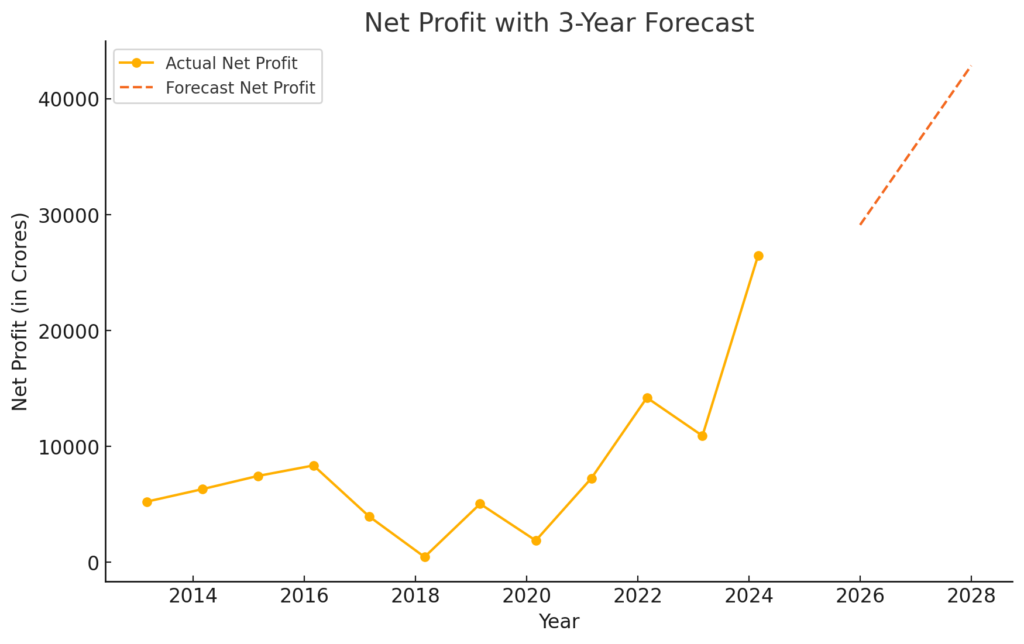

8. Net Profit

Trend: Net profit saw a decline from ₹5,235 crore in 2013 to a low of ₹464 crore in 2018, before a strong recovery to ₹28,052 crore in TTM.

Industry Comparison: The net profit growth in recent years is strong, outperforming the industry average growth of 15%-20% annually for private banks.

Analysis: The fluctuations in net profit were due to high provisions during the NPA crisis. However, the recent surge indicates improved financial health, higher margins, and strong revenue growth.

9. Earnings Per Share (EPS)

Trend: EPS dropped significantly during 2017-2018, reflecting lower profitability, but recovered strongly to ₹90.43 in TTM.

Industry Comparison: The recent EPS growth indicates strong earnings potential, in line with or better than industry peers like HDFC Bank and ICICI Bank.

Analysis: The EPS recovery highlights Axis Bank’s improved profitability and better shareholder value creation.

10. Dividend Payout

Trend: The dividend payout has fluctuated, with higher payouts during profitable years (e.g., 30% in 2020) and lower payouts during challenging years (e.g., 0% in TTM).

Industry Comparison: Industry average dividend payout ratios range from 20%-30%. The variability in Axis Bank’s payout reflects its focus on capital conservation during tough periods and shareholder rewards during profitable years.

Analysis: The inconsistent dividend policy may concern income-focused investors, but it reflects prudent management during financial stress.

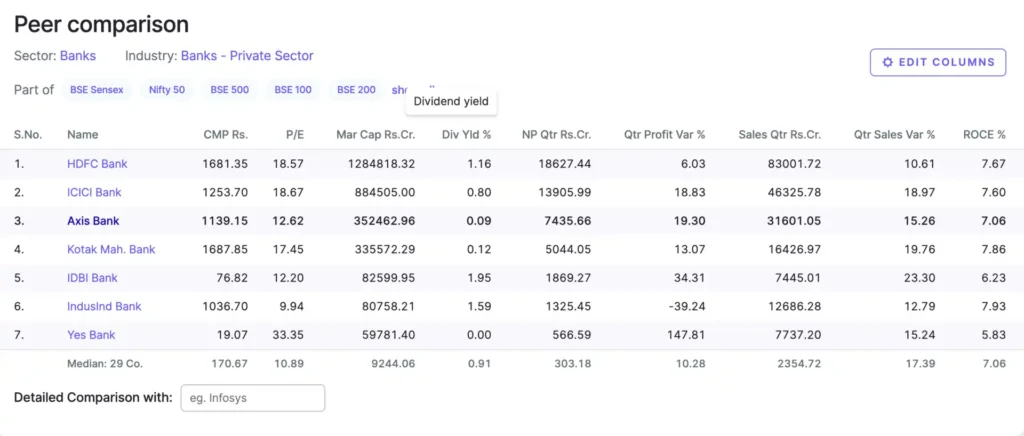

Peer Comparison Analysis

1.Valuation (P/E Ratio):

Axis Bank (12.62 P/E) has a lower P/E ratio compared to HDFC Bank (18.57) and ICICI Bank (18.67), indicating it is relatively undervalued. This could be an opportunity for investors seeking growth at a reasonable price.

Yes Bank’s high P/E ratio (33.35) suggests it is trading at a premium, likely due to market speculation or expectations of a turnaround.

2.Market Capitalization:

Axis Bank ranks third in market capitalization (₹3.52 lakh crore) after HDFC Bank and ICICI Bank. This places it among the top private sector banks in India, reflecting its strong market presence.

HDFC Bank, with a market cap of ₹12.84 lakh crore, remains the largest, showcasing its dominance and market leadership.

3.Dividend Yield:

Axis Bank’s dividend yield of 0.09% is the lowest among its peers, indicating a conservative approach to dividend payouts, possibly focusing more on reinvestment and growth.

In contrast, IDBI Bank (1.95%) and IndusInd Bank (1.59%) offer higher yields, which may appeal to income-focused investors.

4.Net Profit and Profit Growth:

Axis Bank reported a strong quarterly net profit of ₹7,435.66 crore, showing a profit growth of 19.3%, which is higher than HDFC Bank (6.03%) and ICICI Bank (18.83%).

This indicates robust financial performance, driven by improved asset quality, higher interest income, and better cost management.

5.Quarterly Sales and Growth:

Axis Bank’s quarterly sales stood at ₹31,601.05 crore, with a growth of 15.26%, which is competitive compared to peers like ICICI Bank (18.97%) and Kotak Mahindra Bank (19.76%).

The sales growth reflects Axis Bank’s effective customer acquisition, digital banking expansion, and strong retail lending performance.

6.Return on Capital Employed (ROCE):

Axis Bank’s ROCE of 7.06% is slightly lower than HDFC Bank (7.67%) and Kotak Mahindra Bank (7.86%). This indicates room for improvement in utilizing capital efficiently.

IndusInd Bank has the highest ROCE (7.93%), indicating better capital efficiency in generating returns.

Risks and Challenges for Axis Bank Share Price

Asset Quality Concerns:

Axis Bank has faced challenges in the past related to rising NPAs, especially in corporate and wholesale banking.

Although recent improvements are evident, any deterioration in asset quality could impact profitability.

Competitive Pressures:

The private banking sector is highly competitive, with HDFC Bank, ICICI Bank, and Kotak Mahindra Bank leading in various segments.

Axis Bank needs to continue its focus on digital innovation and premium customer segments to maintain its market position.

Regulatory and Economic Risks:

Changes in banking regulations, interest rate fluctuations, and macroeconomic conditions could affect the bank’s lending business and interest margins.

Digital Disruption:

With increasing competition from digital-only banks and fintech companies, Axis Bank must continue investing in technology to enhance customer experience and maintain its competitive edge.

How Axis Bank Tackled the NPA Crisis

| Year | Gross NPA | Net NPA |

| 2014 | 1.6% | 0.6% |

| 2015 | 1.8% | 0.7% |

| 2016 | 2.3% | 1.0% |

| 2017 | 5.2% | 2.2% |

| 2018 | 6.1% | 2.8% |

| 2019 | 5.3% | 2.3% |

| 2020 | 4.9% | 1.9% |

| 2021 | 3.9% | 1.4% |

| 2022 | 2.6% | 1.1% |

| 2023 | 1.96% | 1.72% |

1.Increased Provisions and Write-offs:

During the peak of the NPA crisis (2017-2018), Axis Bank made aggressive provisions to cover bad loans. This impacted profitability in the short term but helped clean up the balance sheet.

The bank also wrote off significant portions of bad debt, which reduced the NPA ratio and improved asset quality.

2.Diversification of Loan Book:

Axis Bank shifted its focus from large corporate loans to retail and SME segments, which are generally considered less risky.

The bank expanded its retail lending portfolio, including home loans, personal loans, and vehicle loans, which helped in reducing the overall risk of the loan book.

3.Project Shikhar and Project Shakti:

Project Shikhar: Launched in 2018, this initiative focused on improving the bank’s recovery and resolution processes.

It involved setting up specialized teams for debt recovery and partnering with asset reconstruction companies (ARCs).

Project Shakti: Introduced to enhance credit appraisal and monitoring processes, utilizing advanced data analytics and early warning systems to detect potential stress in the loan portfolio.

4.Digital Credit Monitoring:

Axis Bank invested heavily in technology, including AI and machine learning, to implement digital credit monitoring tools.

These tools provide early warning signals for potential defaults, allowing the bank to take preventive actions.

The digital transformation also helped streamline the loan approval process, reducing the risk of lending to high-risk borrowers.

5.Restructuring and Resolution Framework:

The bank utilized RBI’s restructuring schemes, especially during the pandemic, to offer relief to stressed borrowers.

This allowed the bank to manage its NPA levels while supporting customers during economic disruptions.

6.Improved Risk Management Practices:

Axis Bank enhanced its risk assessment framework by adopting a more stringent credit appraisal process.

It introduced sector-specific risk models to better evaluate the creditworthiness of borrowers in vulnerable industries.

The bank also implemented a centralized monitoring system for large corporate loans, ensuring better oversight and control.

Roshan Sharma – Founder of StocksForBeginners.in

I’m Roshan Sharma, a stock market trader with 5+ years of experience. At StocksForBeginners.in, I provide expert fundamental analysis of Indian companies to help long-term investors make informed decisions. My mission is to simplify investing for beginners and share insights from my experience to guide others toward financial growth.