Adani Ports and Special Economic Zone Ltd. (APSEZ): India’s largest private port operator, managing 24% of the nation’s cargo across 13 ports in seven states (Gujarat, Maharashtra, Goa, Kerala, Andhra Pradesh, Tamil Nadu, Odisha).

- Founded: 1998 by Gautam Adani.

- Headquarters: Ahmedabad, Gujarat.

- Market Capitalization: ₹1.78 trillion.

- Capacity: 538 million metric tonnes annually, handling dry, liquid, crude, and container cargo.

- Adani Logistics Ltd.: Operates three parks, 500,000 TEUs annually; offers train operations, warehousing, transportation, and value-added services.

- Mundra SEZ: 8,000 hectares; key to economic growth and connectivity.

PSEZ is crucial to India’s economic infrastructure, offering advanced port facilities, enhancing hinterland connectivity, and supporting efficient cargo movement across the nation.

The company’s Mundra SEZ in Gujarat, spanning 8,000 hectares, serves as a landmark multi-product Special Economic Zone and demonstrates the company’s commitment to national economic development.

This article dives deep into Adani Ports’ share price target for the next 10 years, offering an in-depth analysis of its market trends and growth potential. Explore how the company’s financial performance, government policies, and global trade shifts shape its trajectory.

Gain valuable insights into Adani Ports’ competitive edge, risks, and opportunities for investors. Whether you’re a long-term investor or a market enthusiast, this comprehensive guide provides the data and analysis needed to make informed decisions about Adani Ports’ stock.

Will Adani Ports sustain its impressive growth trajectory, or could the stock face a potential correction in the coming years? This in-depth analysis covers Adani Ports’ share price forecast, market trends, and investment insights to help you make informed decisions. Let’s explore!

Company Overview

Adani Ports and Special Economic Zone Ltd. (APSEZ) was established on May 26, 1998, as Gujarat Adani Port Limited, marking a pivotal moment in the Adani Group’s expansion beyond commodity trading. The company’s foundation began in 1995 when the Gujarat state government invited private companies to develop port projects.

Key Establishment :

- Incorporated as Gujarat Adani Port Limited in 1998

- Commenced phased operations at Mundra Port in October 1998

- Started commercial operations in October 2001

- Initially a joint-sector company with Gujarat Port Infrastructure Development Company

- Renamed to Mundra Port and Special Economic Zone Limited in 2006

- Became Adani Ports and Special Economic Zone Limited in 2012

Strategic Role in Adani Group The port venture was a critical strategic move for the Adani Group, which was transitioning from a commodity trading business to a diversified infrastructure conglomerate. Mundra Port became the group’s first major infrastructure project, helping the organization gain prominence in logistics and infrastructure sectors.

Significant Achievements:

- First private port at Mundra in the Gulf of Kutch

- Developed India’s first multi-product port-based Special Economic Zone

- Rapidly expanded to become India’s largest private port operator

- Handled 144.4 million metric tonnes of cargo in 2020-21

- Achieved a remarkable 35% CAGR in the port sector

The port’s development was conceptualized by Gautam Adani and quickly became a cornerstone of the Adani Group’s expansion strategy, transforming from a single port to a nationwide logistics infrastructure powerhouse.

Operation Overview of Adani Ports

Port Network Adani Ports and Special Economic Zone Limited (APSEZ) operates 15 ports across seven maritime states, strategically located in:

- Gujarat: Mundra, Tuna, Dahej, Hazira

- Tamil Nadu: Ennore, Kattupalli

- Odisha: Dhamra

- Goa: Mormugao

- Kerala: Vizhinjam

- Andhra Pradesh: Krishnapatnam

- Puducherry: Karaikal

Logistics Solutions

APSEZ provides comprehensive logistics infrastructure through:

- 11 Logistics Parks

- 3 dedicated logistics parks in Haryana, Punjab, and Rajasthan

- Annual capacity to handle 500,000 twenty-foot equivalent units (TEUs)

- End-to-end logistics services including warehousing, transportation, and custom clearance

Special Economic Zones (SEZ)

The flagship Mundra SEZ in Gujarat stands out with:

- Spanning 8,000 hectares

- Largest multi-product Special Economic Zone in India

- Offers Free Trade and Warehousing Zone (FTWZ)

- Integrated industrial ecosystem supporting diverse business needs

Cargo Handling Capabilities

- The ports are equipped to manage:

- Dry cargo

- Liquid cargo

- Containers

- Bulk and break-bulk cargo

- LPG/LNG

- Crude oil

- Automobiles

With a total port capacity of 627 million tonnes per annum, APSEZ handles approximately 24% of India’s total cargo movement.

Current Financial Highlights of Adani Port

Adani Ports and Special Economic Zone Limited (APSEZ) has demonstrated robust financial performance in the recent quarters and fiscal year. Here are the key financial highlights:

Quarterly Performance (Q2 FY25)

Financial Metrics:

- Net Profit: Rs 2,445 crore (39.90% YoY increase)

- Revenue from Operations: Rs 7,067.02 crore (6.33% YoY increase)

- Total Cargo Handled: 111 million metric tonnes (10% YoY growth)

- Earnings Before Interest, Tax, Depreciation, and Amortisation (EBITDA): Rs 4,369 crore (13% YoY increase)

Annual Performance (FY24)

Key Financial Indicators:

- Total Revenue: Rs 282,615 million (24.9% growth from FY23)

- Net Profit: Rs 81,040 million (50.3% growth from FY23)

- Revenue CAGR (5 years): 19.5%

Financial Ratios

Profitability Ratios:

- Operating Profit Margin: 57.4%

- Net Profit Margin: 30.3%

- Earnings Yield: 0.01-0.04

Leverage Ratios:

- Debt to Equity Ratio: 0.7x

- Current Ratio: 1.24

- Long Term Debt to Equity: 84.97%

Business Segment Performance

- Port Business Revenue: Rs 17,304 crores (FY23)

- Logistics Business Revenue: Rs 1,744 crores (FY23)

- Port Business EBITDA: Rs 12,039 crores with approximately 70% EBITDA margin

Adani Port Fundamental Analysis

The company has shown consistent growth across various financial parameters, maintaining strong operational efficiency and profitability.

| Market Cap | ₹ 2,60,297 Cr |

| Enterprise Value | ₹ 3,06,244.41 Cr. |

| No. of share | 216.01 Cr. |

| P/E | 25.4 |

| P/B | 4.55 |

| Face value | ₹ 2 |

| Dividend Yield (Last Year) | 0.5 % |

| Book Value | ₹136.11 |

| Debt | ₹49,702.30 Cr. |

| EPS | ₹ 45.4 |

| ROE | 18.1 % |

| ROCE | 12.9 % |

| Profit growth (1 year) | 37.2 % |

| Sales growth | 29.97% |

| Cash | ₹ 6,627 Cr |

| Debt to Equity | 0.88 |

| Promoter’s Holding | 65.9 % |

Overview of Indian Port and Logistics Sector

India’s port and logistics sector is a vital contributor to the nation’s economy, facilitating trade, enhancing industrial growth, and enabling seamless goods movement across domestic and global markets.

Economic Contribution of the Sector

The port and logistics sector plays a pivotal role in India’s GDP and employment, while improving trade efficiency and reducing costs.

- Share in GDP: Accounts for 13-14% of India’s GDP.

- Trade Facilitation: Handles 95% of trade by volume and 70% by value.

- Employment: Provides jobs to over 22 million people.

- Logistics Costs: Represents 14% of GDP, with expectations of a decline in the future.

Key Economic Impacts

Efficient port and logistics infrastructure has a multiplier effect on India’s economic growth and competitiveness.

- Cost Reduction: Minimizes transportation and logistics expenses.

- Industrial Development: Drives industrialization by improving connectivity.

- Foreign Trade Support: Enhances export-import operations.

- Goods Movement: Ensures efficient and seamless movement of products.

Government Initiatives Driving Growth

The Indian government has implemented landmark initiatives to optimize infrastructure and integrate advanced connectivity across the logistics ecosystem.

1. Sagarmala Programme (2015)

This flagship program focuses on reducing logistics costs and modernizing port infrastructure.

Projects Overview:

- Total Projects: 802

- Completed Projects: 221 (worth ₹1.12 lakh crore)

- Ongoing Projects: 581 (worth ₹4.28 lakh crore)

Key Objective: Optimize port connectivity and infrastructure.

2. PM Gati Shakti National Master Plan (2021)

A transformative plan emphasizing coordinated, multi-modal connectivity across India.

Focus Areas:

- Seamless integration of infrastructure planning.

- Boosts multi-modal transport networks for efficiency.

Strategic Developments in the Sector

India is leveraging its geographical advantage and policy reforms to bolster port capacity and attract investments.

- FDI: 100% Foreign Direct Investment (FDI) allowed in port projects.

- Port Network: 12 major ports and 217 non-major ports along the coastline.

- Coastline Advantage: A 7,517 km coastline enhances India’s maritime potential.

- Capacity Targets: Aims to achieve a port handling capacity of 3,300 MTPA by 2025.

The port and logistics sector remains a cornerstone of India’s economic strategy, driving trade efficiency, reducing costs, and supporting national development goals.

Adani Ports’ Market Position and Strategic Significance

Adani Ports and Special Economic Zone (APSEZ) is a leader in India’s port infrastructure, driving economic growth through strategic expansion, operational efficiency, and technological innovation.

Market Share and Cargo Volume

Adani Ports dominates the Indian port sector, setting industry benchmarks in market share and cargo volume, showcasing its robust operational performance and ability to capture growing demand.

Market Share:

- Commands 26% of India’s port sector.

- Achieved a 200 basis point increase in Q1 FY24.

Cargo Volume Highlights:

- Handled 101.4 million metric tonnes (MMT) in Q1 FY24.

- Demonstrated 12% year-on-year growth in cargo volumes.

- Domestic cargo volumes surged by 8%, outperforming India’s overall cargo volume growth rate by 3x.

Port Network and Strategic Importance

With 14 strategically located ports, Adani Ports forms the backbone of India’s maritime trade, fostering seamless connectivity and economic resilience.

Port Network Overview:

- Operates a total of 14 ports across India.

- Strategic distribution across Gujarat, Maharashtra, Goa, Kerala, Tamil Nadu, and Andhra Pradesh.

Key Ports:

- Mundra Port (Gujarat): India’s largest port and a critical trade hub.

- Krishnapatnam Port (Andhra Pradesh): Major gateway for eastern trade.

- Karaikal Port (Tamil Nadu): Enhances connectivity to southern markets.

Strategic Importance:

- Supports 95% of India’s trade by volume, showcasing its pivotal role in the national economy.

- Functions as a cornerstone of the multi-modal transportation and logistics ecosystem.

Operational Excellence

Adani Ports leads the industry with world-class operational standards, driven by efficiency, state-of-the-art infrastructure, and commitment to excellence in port management.

Efficiency Metrics:

- Achieved an industry-leading average ship turnaround time of ~0.7 days.

- Contributed to reducing the turnaround time at major ports from 5 days (2011) to 2 days (current levels).

Operational Infrastructure:

- Manages 9 advanced logistics parks, offering end-to-end logistics solutions.

- Operates hundreds of warehouses for seamless cargo storage and distribution.

- Owns thousands of acres of industrial land, facilitating integrated supply chain networks.

Strategic Significance

Adani Ports is integral to India’s trade infrastructure, enhancing national economic growth through cutting-edge solutions and unparalleled capacity in the maritime sector.

Critical Role in Trade:

- Handles 95% of India’s trade by volume, making it the backbone of India’s maritime operations.

- Accelerates economic growth by enabling robust import-export operations.

Support for Transportation and Logistics Ecosystem:

- Integrates sea, rail, road, and air connectivity for a multi-modal approach.

- Drives efficiency through technological innovation and expansive logistics infrastructure.

Economic Catalyst:

- Powers industrial expansion with strategic port locations.

- Facilitates India’s rise as a global trade leader through consistent infrastructure upgrades and expansions.

Adani Ports Growth Strategy 2024–2030

Adani Ports and Special Economic Zone (APSEZ) has outlined an ambitious roadmap for growth by 2030, focusing on scaling capacity, infrastructure modernization, and strategic global expansion.

Strategic Cargo Volume Targets

To maintain its industry leadership, Adani Ports is scaling up its cargo-handling capabilities to meet growing global trade demands and support India’s burgeoning economy.

Cargo Capacity Milestones:

- Current Capacity: 633 million metric tonnes (MMT).

- Target Capacity: 2,000 MMT by 2030.

- Annual Cargo Goal: Handle 1 billion tons annually by 2030.

Investment Plans:

- A dedicated $3 billion expansion fund to bolster infrastructure and operations.

Key Growth Initiatives

Adani Ports is executing a multi-faceted strategy, focusing on international expansion, infrastructure enhancement, and connectivity improvements to strengthen its market position.

Global Port Acquisitions:

- Expanding presence in Middle East and Africa through acquisitions.

- Secured a 30-year concession to operate Tanzania’s Dar es Salaam Port, a critical East African trade hub.

Infrastructure Development:

- Developing multi-commodity berths to handle diverse cargo types.

- Constructing liquid jetties to support the growing demand for liquid bulk transportation.

- Upgrading railway and road networks for seamless cargo movement.

- Modernizing port infrastructure with cutting-edge technology and automation.

Performance Highlights

Adani Ports has demonstrated robust growth across key operational metrics, reinforcing its commitment to scaling volumes and enhancing efficiency.

Cargo Volume Growth:

- Achieved 8% year-on-year growth in the first half of FY25.

- Handled 219.8 MMT of cargo in H1 FY25.

- Recorded a 14% growth in cargo volumes in September 2024.

Container Traffic:

- Notable 31% year-on-year surge, reflecting strong demand and operational capacity.

Logistics Expansion:

- 11% increase in rail volumes, supporting efficient inland cargo movement.

- 20% growth in warehousing volumes, strengthening supply chain solutions.

Strategic Vision

Adani Ports aims to transform into the world’s largest integrated ports and logistics platform, guided by a clear vision of sustainability, growth, and global competitiveness.

Global Leadership Goals:

- Position itself as the world’s largest ports and logistics platform within the next decade.

- Capture global trade opportunities through strategic domestic and international operations.

Sustainability Commitments:

- Achieve carbon neutrality by 2025, aligning with global environmental goals.

- Invest in green energy and eco-friendly port operations.

Multi-Modal Logistics:

- Establish comprehensive multi-modal logistics infrastructure integrating sea,rail, road, and air connectivity.

- Expand warehousing and inland transportation capabilities to support end-to-end supply chain solutions.

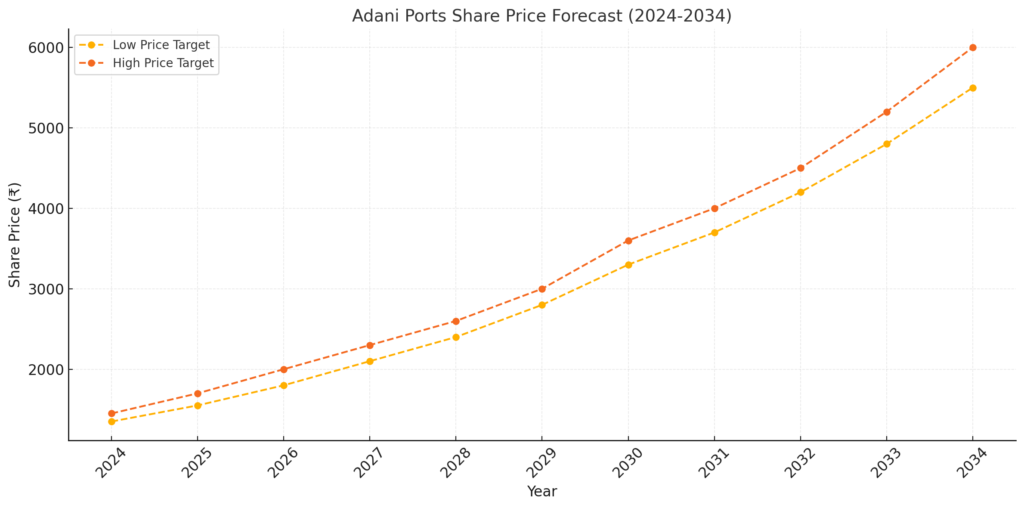

Adani Port Share Price Target 2025-2035

| Adani Port Share Price Target (Year) | Price |

| Adani Port Share Price Target 2025 | ₹1,550 |

| Adani Port Share Price Target 2026 | ₹1,800 |

| Adani Port Share Price Target 2027 | ₹2,100 |

| Adani Port Share Price Target 2028 | ₹2,400 |

| Adani Port Share Price Target 2029 | ₹2,800 |

| Adani Port Share Price Target 2030 | ₹3,300 |

| Adani Port Share Price Target 2031 | ₹3,700 |

| Adani Port Share Price Target 2032 | ₹4,200 |

| Adani Port Share Price Target 2033 | ₹4,800 |

| Adani Port Share Price Target 2034 | ₹5,500 |

| Adani Port Share Price Target 2035 | ₹6,015 |

Adani Port Share 2025: Target Price ₹1,550–₹1,700

In 2025, Adani Ports is expected to complete its carbon neutrality goals and generate substantial revenue from logistics diversification, including LNG and LPG handling. The operational launch of Vizhinjam Port will provide additional cargo capacity, contributing to growth. By this year, Adani Ports is projected to capture a 30% share of Indian port volumes, strengthening its position as a leading logistics provider.

Adani Port Share 2026: Target Price ₹1,800–₹2,000

Higher profitability in 2026 is attributed to operational efficiency improvements and increased SEZ revenue, particularly from warehousing and industrial zones near Mundra SEZ. India’s economic growth at 6–7% CAGR will further support this trajectory. The company’s ability to maintain strong cash flows through these initiatives makes this price range feasible.

Adani Port Share 2027: Target Price ₹2,100–₹2,300

Adani Ports’ international expansion efforts in Asia and Africa will begin yielding significant returns by 2027. The company’s focus on containerized cargo and the adoption of digital innovations to enhance operational efficiency will further drive its valuation. These initiatives justify the higher price target for this year.

Adani Port Share 2028: Target Price ₹2,400–₹2,600

In 2028, Adani Ports is forecasted to consolidate its position as a market leader with a 35% share of India’s port cargo handling market. Its fully integrated multi-modal logistics system, including rail and inland waterways, will contribute to long-term revenue growth. These developments will push its share price into the ₹2,400–₹2,600 range.

Adani Port Share 2029: Target Price ₹2,800–₹3,000

Increased focus on hinterland connectivity and inland freight corridors is expected to significantly boost Adani Ports’ revenues in 2029. The company’s ability to offer integrated port-to-door solutions positions it for strong growth, driving its valuation to ₹2,800–₹3,000.

Adani Port Share 2030: Target Price ₹3,300–₹3,600

By 2030, Adani Ports is expected to fulfill its Vision 2030 of becoming the world’s largest private port operator. The company is projected to handle over 40% of India’s port cargo volumes, driven by expansions in LNG and LPG handling, warehousing, and inland logistics. These achievements will position the stock at ₹3,300–₹3,600.

Adani Port Share 2031: Target Price ₹3,700–₹4,000

Global collaborations, particularly in Africa and the Middle East, will drive Adani Ports’ growth in 2031. Increased adoption of smart port technologies will enhance operational efficiency, contributing to higher profitability and a projected share price of ₹3,700–₹4,000.

Adani Port Share 2032: Target Price ₹4,200–₹4,500

In 2032, Adani Ports is expected to achieve sustained growth by optimizing cost structures and adopting advanced technologies. The company’s diversified revenue streams, including inland logistics and renewable energy integration, will support a price target of ₹4,200–₹4,500.

Adani Port Share 2033: Target Price ₹4,800–₹5,200

Incremental revenue from inland connectivity projects and strategic acquisitions will continue to drive growth in 2033. Adani Ports’ ability to maintain consistent cash flows and profitability will make it an attractive investment, justifying a price target of ₹4,800–₹5,200.

Adani Port Share 2034: Target Price ₹5,500–₹6,000

By 2034, Adani Ports will likely transition into a mature growth phase, delivering steady returns and dividends to investors. The company’s strong cash flows and high return on capital employed will support a share price of ₹5,500–₹6,000, cementing its position as a leader in the logistics sector.

Adani Vs JSW Infra Vs Gujarat Pipavav

| Matrices | Adani Port | JSW Infra | Gujrat Pipava |

| Current Market Price (CMP ₹) | 1205.00 | 313.60 | 191.28 |

| Price-to-Earnings Ratio (P/E) | 25.45 | 52.95 | 22.72 |

| Market Capitalization (₹ Cr) | 2,60,296.74 | 65,856.05 | 9,247.24 |

| Net Profit (Quarterly ₹ Cr) | 2412.54 | 373.73 | 91.50 |

| Quarterly Profit Variation (%) | 40.37 | 46.03 | -12.88 |

| Quarterly Sales Variation (%) | 6.33 | 18.04 | -10.12 |

| Return on Capital Employed (ROCE %) | 12.93 | 16.41 | 24.80 |

| Dividend Yield (%) | 0.50 | 0.18 | 3.82 |

1.Current Market Price (CMP):

Adani Ports has a CMP of ₹1205, significantly higher than its peers, reflecting strong investor confidence and market positioning.

2.Price-to-Earnings Ratio (P/E):

- Adani Ports P/E: 25.45

- JSW Infra P/E: 52.95

- Gujarat Pipavav P/E: 22.72

A lower P/E ratio indicates that Adani Ports is relatively cheaper than JSW Infra but slightly more expensive than Gujarat Pipavav. This is a reasonable valuation given its leadership position and growth prospects.

3.Market Capitalization (Mar Cap):

Adani Ports has a market cap of ₹2,60,296 Cr, dwarfing its competitors. This highlights its dominance in the sector and its role as a key player in India’s port and logistics infrastructure.

4.Net Profit (Quarterly):

- Adani Ports: ₹2412.54 Cr

- JSW Infra: ₹373.73 Cr

- Gujarat Pipavav: ₹91.50 Cr

Adani Ports generates far higher net profit, demonstrating superior profitability and scale.

5.Quarterly Profit Variation (%):

- Adani Ports: 40.37%

- JSW Infra: 46.03%

- Gujarat Pipavav: -12.88%

While JSW Infra has a slightly higher profit growth rate, Adani Ports still shows robust performance with a 40.37% growth in profits.

6.Quarterly Sales Variation (%):

- Adani Ports: 6.33%

- JSW Infra: 18.04%

- Gujarat Pipavav: -10.12%

Adani Ports’ sales growth is modest compared to JSW Infra, but it still outperforms Gujarat Pipavav significantly. This indicates stability, as Adani Ports has already reached a high revenue base.

7.Return on Capital Employed (ROCE %):

- Adani Ports: 12.93%

- JSW Infra: 16.41%

- Gujarat Pipavav: 24.80%

Gujarat Pipavav leads in ROCE, followed by JSW Infra. Adani Ports’ ROCE is lower, likely due to its large-scale investments and capital-intensive operations. However, this does not indicate poor performance but rather reflects its growth stage.

Adani Ports: Strategic Strengths in Driving Operational Excellence

Adani Ports and Special Economic Zone Ltd. (APSEZ) has firmly established itself as a leader in India’s port infrastructure sector. Through unparalleled operational efficiency, technological innovation, and robust infrastructure, the company continues to solidify its position as a key enabler of India’s economic growth. Below is a detailed analysis of the company’s strategic strengths.

Adani Ports operates at an unmatched scale, handling a substantial share of India’s port traffic. This scale positions the company as a dominant player in the sector.

1. Scale of Operations

Impressive Cargo Handling Performance:

- Managed 311 MMT (million metric tons) of total cargo in the first nine months of FY24.

- Achieved an outstanding 42% year-on-year growth in cargo volume in December 2023.

- Set a milestone by crossing 300 MMT cargo within just 266 days, a record in Indian port history.

Extensive Network of Ports:

- Operates 14 strategically located ports across India, covering both east and west coasts.

- Expanding its footprint internationally, cementing its position in global logistics.

Future Growth Targets:

Aiming for 400 MMT cargo volumes by the end of FY24, demonstrating its ambitious growth trajectory.

2. Operational Efficiency

Adani Ports leverages its operational efficiency to set benchmarks for the industry, driven by state-of-the-art capabilities and advanced infrastructure.

Mundra Port’s Achievements:

- Handled 5.5 million TEUs (twenty-foot equivalent units) in just nine months.

- Processed over 3,000 ships in just 261 days, reflecting its rapid turnaround capabilities.

- Recorded the highest cargo volumes for any Indian port in a single month.

Capability to Handle Large Vessels:

Successfully berthed record-breaking ships, showcasing its expertise in handling large-scale operations:

- MV MSC Hamburg: 399 meters long with 15,908 TEUs.

- MV CMA CGM Figaro: Managed 114 oversized and out-of-gauge cargo units.

Advanced berthing and cargo-handling capabilities optimize time and cost for customers.

3. Technology and Infrastructure Integration

Adani Ports has heavily invested in advanced technology and infrastructure, positioning itself as a fully integrated transport utility.

End-to-End Solutions:

Offers seamless logistics services combining port operations, rail connectivity, and diversified cargo handling.

Cutting-Edge Infrastructure:

Advanced port facilities cater to various cargo types, including dry bulk, containers, and liquid cargo.

Railway connectivity significantly improved through:

- Commissioning a 9.687 km railway doubling line, ensuring faster and more efficient cargo movement.

- Launching double-stack rail services through the Western Dedicated Freight Corridor, enhancing capacity and efficiency.

Technological Innovation:

Continues to implement advanced systems to optimize operations and ensure real-time tracking and management of cargo flows.

4. Diversified Cargo Handling

Adani Ports is equipped to manage a broad spectrum of cargo, contributing to its resilience and operational versatility.

Handling Capabilities Across:

- Dry Bulk: Commodities like coal, iron ore, and agricultural products.

- Containers: Significant container handling volumes, with state-of-the-art equipment.

- Liquids: Capability to manage petroleum, chemicals, and other liquid cargoes.

What are the key factors Driving Adani ports future growth plans

Key Drivers of Adani Ports’ Future Growth

- Strategic Infrastructure Expansion

- Targeting 1 billion tonnes cargo handling by 2030

- Investing $3 billion in port infrastructure

- Expanding port network from 14 to multiple international locations

- Developing multi-commodity berths and liquid jetties

Technological Innovation

- Embracing digitalization and automation

- Investing in cutting-edge port handling technologies

- Implementing IoT and advanced logistics solutions

- Enhancing operational efficiency through technological upgrades

Government Policy Support

- Benefiting from initiatives like Sagarmala and Gati Shakti

- Aligned with national infrastructure development goals

- Receiving favorable trade and logistics policy environment

Diversification Strategy

Expanding beyond port services into:

- Logistics

- Warehousing

- Transportation services

- Creating comprehensive supply chain solutions

Market Positioning

- Current market share: 26% of India’s port sector

- Targeting international port acquisitions

- Focusing on strategic locations near industrial corridors

- Developing infrastructure to handle mega-ships

Financial Growth Drivers

- Projected 15% revenue CAGR from FY23-25

- 12% volume growth expected

- Strong cash flow generation

- Debt management through strategic investments

These multifaceted growth strategies position Adani Ports for substantial expansion in the coming decade.

Adani Port Financial Performance

1. Revenue Growth (Sales)

- Performance: Adani Ports’ revenue has grown consistently over the years. From ₹3,577 crores in March 2013 to ₹26,711 crores in March 2024, showing a CAGR of approximately 22%.

- Recent Trends: FY 2024 witnessed a 28% YoY growth in sales (from ₹20,852 crores in FY 2023 to ₹26,711 crores in FY 2024), driven by increased cargo volumes and acquisitions.

- Industry Comparison: The industry average revenue growth rate is typically around 10–12% CAGR, positioning Adani Ports well above the average and ahead of peers like Gujarat Pipavav, which exhibits slower growth due to limited scale.

2. Operating Profit (EBITDA)

- Performance: Operating profit rose from ₹2,382 crores in 2013 to ₹15,589 crores in 2024. The Operating Profit Margin (OPM) has remained healthy, averaging 60% over the years, peaking at 69% in FY 2021.

- Recent Trends: OPM recovered to 58% in FY 2024 after dipping to 52% in FY 2023, indicating improved cost control and operational efficiency.

- Comparison with Peers: Adani Ports’ OPM (58–60%) is significantly higher than peers like JSW Infrastructure (40–45%) and Gujarat Pipavav (~45%), reflecting its ability to handle diverse cargo and economies of scale.

3. Net Profit

- Performance: Net profit has grown from ₹1,639 crores in FY 2013 to ₹8,104 crores in FY 2024. Adani Ports demonstrated resilience in FY 2023 despite macroeconomic challenges, with net profit increasing YoY.

- EPS Growth: EPS has increased from ₹8.10 in 2013 to ₹37.55 in 2024, showcasing strong shareholder value creation.

- Industry Comparison: Adani Ports’ net profit margin of ~30% in FY 2024 outperforms many peers, thanks to its diversified cargo portfolio and integrated logistics operations.

4. Expenses and Cost Management

- Trend: While expenses have grown, the company maintains robust operational efficiency, evident in the consistent OPM. The rise in depreciation and interest costs aligns with the company’s aggressive capital expenditure for infrastructure development and acquisitions.

- Comparison: Adani Ports’ cost efficiency and margins surpass peers like JSW Infrastructure, which has a higher cost base due to its limited diversification and scale.

5. Dividend Payout

- Trend: Adani Ports has maintained a balanced dividend policy, with payout ratios ranging from 7% to 20%. This indicates reinvestment of profits into growth while providing consistent returns to shareholders.

- Peer Comparison: Dividend yields for peers like Gujarat Pipavav are higher but reflect a lack of significant reinvestment opportunities.

6. Compounded Profit Growth

| Time Frame | Growth Rate |

| 10 Years | 18% |

| 5 Years | 17% |

| 3 Years | 21% |

| TTM | 21% |

Analysis:

- Sustained Profit Growth: Over the past 10 years, profit growth has been consistent at 18% CAGR, which aligns with its ability to expand capacity and maintain high operational efficiency.

- Exceptional Recent Performance: The TTM profit growth of 37% reflects a significant improvement in profitability, driven by cost optimization and increased cargo volumes post-pandemic.

- Comparison: The company’s profit growth surpasses many peers in the ports sector, which typically see a 12–15% profit CAGR over 10 years.

7. Stock Price CAGR

| Time Frame | Growth Rate |

| 10 Years | 15% |

| 5 Years | 26% |

| 3 Years | 20% |

| TTM | 19% |

Analysis:

- Steady Returns: Adani Ports’ stock has delivered 15% CAGR over 10 years, showing consistent long-term value creation for investors.

- Recent Momentum: The 5-year CAGR of 26% and 1-year return of 19% indicate growing investor confidence, backed by the company’s strong financial performance and expansion strategy.

- Industry Benchmark: Adani Ports’ stock price growth significantly outpaces the logistics sector average of 12–14% CAGR.

8. Compounded Sales Growth

| Time Frame | Growth Rate |

| 10 Years | 19% |

| 5 Years | 20% |

| 3 Years | 29% |

| TTM | 21% |

Analysis:

- Long-term Growth: Adani Ports has maintained a robust compounded sales growth rate of 19% over 10 years, reflecting steady demand and expansion.

- Acceleration in Recent Years: The growth over the last 3 years (29%) and TTM period (21%) shows the company has accelerated its revenue growth trajectory, likely driven by acquisitions, increased cargo handling, and a favorable macroeconomic environment.

- Comparison: The 10-year growth rate of 19% outpaces the logistics and port industry’s average of 10–12% CAGR, highlighting Adani Ports’ market leadership.

9. Return on Equity (ROE)

| Time Frame | Growth Rate |

| 10 Years | 18% |

| 5 Years | 16% |

| 3 Years | 16% |

| TTM | 18% |

Analysis:

- Consistent Efficiency: The ROE of 18% over 10 years reflects effective use of shareholder equity to generate profits.

- Improvement in FY 2024: The return to 18% last year after a dip to 16% over the past 5 years suggests operational improvements and better profitability.

- Comparison: Adani Ports’ ROE is above the logistics sector average of 12–15%, highlighting its superior profitability and efficient capital allocation.

Adani Ports exhibits robust financial metrics across all timeframes, with particularly strong growth in recent years. The company’s compounded sales and profit growth reflect its ability to capture market opportunities, expand operations, and improve efficiency.

Stock price CAGR aligns with its financial performance, indicating strong investor confidence.

Return on Equity remains impressive, reflecting efficient utilization of capital and strong profitability.

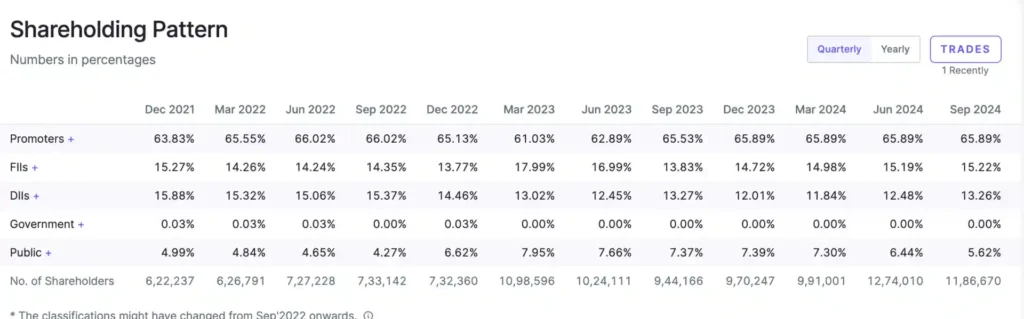

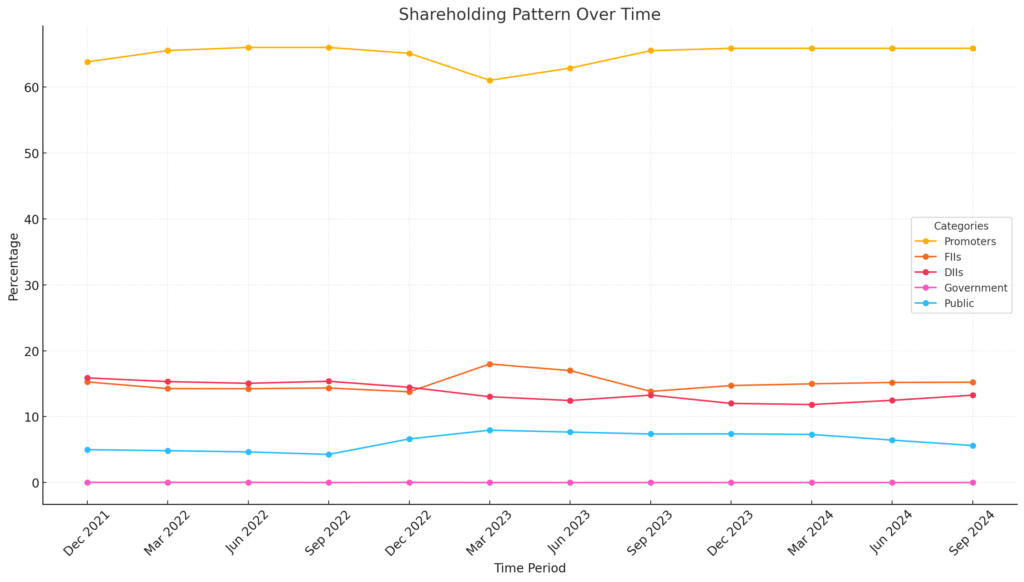

Adani Port Share Holding Pattern Analysis

1. Promoters’ Holding

Trend: Promoters’ holding has fluctuated between 61.03% (March 2023) and 66.02% (June 2022 and September 2022), stabilizing at 65.89% in recent quarters (March 2024 to September 2024).

The consistently high promoter holding reflects strong control and confidence in the company.

The slight decrease from 66.02% (2022) to 61.03% (March 2023) could indicate stake adjustments, possibly to raise funds or comply with regulatory norms.

Stabilization at 65.89% in 2024 suggests no further significant stake dilution.

High promoter confidence typically reassures investors and enhances stability.

2. Foreign Institutional Investors (FIIs)

Trend: FII holding has decreased from 15.27% (December 2021) to 13.83% (September 2023) but has rebounded to 15.22% (September 2024).

The decline in FII holdings during 2022–2023 could be attributed to global macroeconomic uncertainty, interest rate hikes, and risk-off sentiment in emerging markets.

The rebound in 2024 indicates renewed foreign investor confidence in Adani Ports, possibly due to improved financial performance and favorable long-term growth prospects.

Increasing FII participation in 2024 highlights strengthening global interest in the company.

3. Domestic Institutional Investors (DIIs)

Trend: DII holding has declined from 15.88% (December 2021) to 11.84% (March 2024) but shows signs of recovery, reaching 13.26% (September 2024).

The decline in DII holdings during 2022–2024 reflects portfolio realignment or profit-booking amid market volatility.

The recent increase in DII holdings in 2024 suggests domestic investors are regaining confidence in the company’s growth trajectory.

Higher DII interest often indicates robust fundamentals and long-term potential.

4. Public Holding

Trend: Public holding has increased significantly from 4.99% (December 2021) to 7.95% (March 2023) and then slightly declined to 5.62% (September 2024).

The initial increase in public shareholding could be due to increased retail participation and broader market interest.

The recent decline suggests retail investors may have booked profits or moved to other opportunities.

Increased public participation during the earlier period shows rising popularity, but the recent decline indicates cautious retail sentiment.

5. Total Number of Shareholders

Trend: The total number of shareholders has grown significantly from 6.22 lakh (December 2021) to 12.74 lakh (June 2024) before slightly decreasing to 11.86 lakh (September 2024).

This sharp increase in the number of shareholders highlights growing interest from retail and institutional investors, driven by the company’s consistent performance and growth.

The slight decline in the latest quarter may indicate some profit booking by retail investors.

The broadening shareholder base reflects increased confidence in the company, but sustained retail participation will depend on continued growth and performance.

1.Promoter Confidence:

The consistently high promoter holding (>65%) underscores strong confidence in the company’s long-term growth prospects and leadership stability.

2.Institutional Interest:

The decrease in FII and DII holdings during 2022–2023 reflects global and domestic macroeconomic challenges.

The recovery in 2024 suggests improving investor sentiment driven by Adani Ports’ robust financials and long-term strategic plans.

3.Retail Participation:

The significant increase in public shareholding and total shareholders between 2021 and 2024 indicates rising retail interest, driven by Adani Ports’ visibility and performance.

Comparison with Industry Peers

Promoter Holding: Adani Ports’ promoter holding (~65%) is higher than many peers, indicating strong leadership control. For example, Gujarat Pipavav Ports has lower promoter holding (~40–50%).

Institutional Participation: Adani Ports attracts significant FII and DII interest compared to peers like Gujarat Pipavav or JSW Infra, reflecting its larger scale and growth prospects.

Retail Participation: The rising number of shareholders highlights broader market trust compared to peers with slower retail traction.

Risks and Challenges

Adani Ports and Special Economic Zone (APSEZ), a key entity within the Adani Group, is currently navigating a complex landscape of regulatory, economic, and competitive challenges. Recent developments have intensified scrutiny on the conglomerate, necessitating a detailed examination of the risks and strategic responses involved.

Regulatory Compliance Risks

APSEZ has encountered significant regulatory challenges, including:

- SEBI Show Cause Notices: In Q4 FY24, the Securities and Exchange Board of India (SEBI) issued two show cause notices to APSEZ, alleging non-compliance with listing agreement provisions and related party transaction regulations.

- Allegations of Improper Fund Utilization: Concerns have been raised regarding the utilization of funds, with allegations suggesting deviations from declared purposes.

- Ongoing Regulatory Scrutiny: Following the Hindenburg Research report, which accused the Adani Group of stock manipulation and accounting fraud, regulatory bodies have intensified their scrutiny of the conglomerate’s operations.

Economic and Trade Challenges

The global logistics sector is experiencing a downturn, presenting challenges such as:

- Slowing Growth: Transport and logistics growth projections indicate a decline, with expected growth rates of 4% in 2023 and 3% in 2024.

- Protectionist Trade Policies: The rise of protectionist trade measures globally poses potential threats to international trade volumes, directly impacting port operations.

- Market Dynamics: Factors like excess inventory levels and reduced consumer spending are adversely affecting the logistics industry, leading to decreased demand for port services.

Competitive Landscape Challenges

APSEZ faces increasing competition and technological disruptions, including:

- Global Competition: The port logistics sector is witnessing heightened competition from both established players and emerging market entrants, challenging APSEZ’s market share.

- Technological Advancements: Rapid technological changes necessitate continuous infrastructure modernization to maintain operational efficiency and competitiveness.

- Sustainability Pressures: There is growing pressure to adopt sustainable logistics practices, requiring significant investment in green technologies and processes.

Recent Developments and Ongoing Challenges

The Adani Group is currently contending with several significant challenges:

- U.S. Bribery Allegations: In November 2024, U.S. prosecutors indicted Gautam Adani and other executives on charges of orchestrating a $265 million bribery scheme to secure solar energy contracts in India.

- Project Cancellations: Following the indictment, Kenya canceled over $2.5 billion in deals with the Adani Group, including the takeover of Jomo Kenyatta International Airport and other energy projects.

- Regulatory Settlements: Entities associated with the Adani Group have approached SEBI to settle allegations of violating public shareholding regulations, indicating ongoing regulatory challenges.

Strategic Mitigation Approaches

To address these multifaceted challenges, APSEZ is implementing several strategic measures:

- Enhancing Regulatory Compliance: Strengthening compliance frameworks to ensure adherence to all regulatory requirements and mitigate legal risks.

- Diversification: Expanding port and logistics services to reduce dependency on any single revenue stream and enhance resilience against market fluctuations.

- Technological Investments: Investing in advanced technologies, including automation and digital transformation initiatives, to improve operational efficiency and competitiveness.

- Sustainable Practices: Committing to sustainable logistics practices by integrating green technologies and adhering to environmental regulations to meet global standards.

Navigating these challenges is crucial for APSEZ to maintain its market leadership and continue its growth trajectory in an increasingly complex and competitive environment.

Roshan Sharma – Founder of StocksForBeginners.in

I’m Roshan Sharma, a stock market trader with 5+ years of experience. At StocksForBeginners.in, I provide expert fundamental analysis of Indian companies to help long-term investors make informed decisions. My mission is to simplify investing for beginners and share insights from my experience to guide others toward financial growth.