HDFC Asset Management Company Limited (HDFC AMC), established on December 10, 1999, is a leading financial institution in India, serving as the Investment Manager to HDFC Mutual Fund, the largest mutual fund in the country.

With Assets Under Management (AUM) of ₹6.1 lakh crore as of March 31, 2024, HDFC AMC is the second-largest listed Asset Management Company in India, holding an 11.6% market share as of May 2023.

The company offers a wide array of investment products, including equity, debt, liquid, exchange-traded, and fund-of-fund schemes, catering to diverse clients like corporates, HNIs, and institutional investors.

Backed by a robust network of over 75,000 distribution partners across 228 branches, HDFC AMC remains a key player in India’s financial market with a focus on research-driven investments and long-term value creation.

The purpose of the article is to provide an in-depth analysis of HDFC AMC’s current performance, evaluate its future prospects, and forecast its share price for the period 2025-2035 based on historical data and market trends.

By examining the company’s financials, market position, and growth potential, this article aims to help investors assess HDFC AMC’s investment potential and make informed decisions.

HDFC Asset Management Company Limited (HDFC AMC) History

Incorporated on December 10, 1999, in Mumbai, HDFC AMC is a public limited company established under the Companies Act, 1956. The company received approval from SEBI to manage mutual fund schemes in July 2000, marking the beginning of its journey as a key player in India’s financial market.

Key Milestones:

- 1999: Incorporated as a public limited company

- 2000: Gained SEBI approval and achieved ₹6.5 billion AUM by September

- 2001: Standard Life Investments became a shareholder

- 2003: Acquired Zurich Asset Management Company Limited

- 2014: Acquired Morgan Stanley Mutual Fund schemes

HDFC AMC Ownership and Leadership:

HDFC Bank holds a 52.55% stake in HDFC AMC. The company is led by Navneet Munot, Managing Director and CEO since February 16, 2021, and Deepak Parekh, Chairman since July 4, 2000.

Current Scale

HDFC AMC serves 9.6 million unique mutual fund investors, manages 16.6 million active accounts, and operates through 254 branches with the support of 85,000 distribution partners.

Investment Philosophy

With a commitment to wealth creation for every Indian, HDFC AMC emphasizes thorough research, controlled risk management, and long-term value creation, positioning itself as a trusted partner for investors nationwide.

HDFC AMC Product and Service Offerings

HDFC Asset Management Company Limited (HDFC AMC) offers a comprehensive suite of investment products and services tailored to meet diverse investor needs.

Product Categories and Market Share

HDFC AMC offers a diverse range of investment products, including equity, debt, hybrid, and specialized funds, with a strong market presence and significant share across each product category.

1.Equity Funds

- Diversified Equity: Invests across various sectors to mitigate risk.

- Index Funds: Tracks specific indices, offering passive investment options.

- Thematic/Sectoral Equity: Focuses on specific sectors or themes, such as technology or healthcare.

- Small Cap Funds: Targets investments in smaller companies with high growth potential.

- Mid-Cap Funds: Invests in mid-sized companies, balancing growth and stability.

As of December 31, 2024, HDFC AMC’s actively managed equity-oriented Quarterly Average Assets Under Management (QAAUM) stood at ₹4,78,200 crore, capturing a market share of 12.8% in this segment.

2.Debt Funds

HDFC AMC’s debt funds provide stable investment options by focusing on theme-based, duration-specific, and liquid instruments, catering to investors seeking predictable returns, low risk, and efficient portfolio diversification.

- Theme-Based Debt: Invests based on specific themes, such as corporate bonds or government securities.

- Duration-Based Debt: Focuses on bonds with specific maturities to manage interest rate risk.

- Liquid Funds: Provides high liquidity by investing in short-term instruments.

In the debt mutual fund space, HDFC AMC held a market share of 13.2% as of December 2024.

3.Hybrid Funds

HDFC AMC’s hybrid funds blend equity and debt investments, offering balanced risk and return. These funds cater to diverse financial goals, including retirement planning and education, through solution-oriented and balanced investment options.

- Solution-Oriented Funds: Designed for specific goals like retirement or children’s education.

- Balanced Funds: Combines equity and debt investments to balance risk and return.

4.Specialized Offerings

- Equity Linked Savings Scheme (ELSS): Offers tax benefits under Section 80C with a lock-in period.

- Exchange Traded Funds (ETFs): Trades on stock exchanges, providing exposure to indices or commodities.

- Fund of Funds (FOFs): Invests in a portfolio of other mutual funds.

- Gold Funds: Provides exposure to gold as an asset class.

HDFC AMC Investment Services

HDFC AMC’s investment services include Portfolio Management, Segregated Accounts, and Alternative Investment Funds, delivering customized solutions for high-net-worth individuals, corporates, and institutions to achieve tailored financial goals with expert guidance.

1.Portfolio Management Services (PMS):

Offers tailored investment solutions for high net worth individuals (HNIs), focusing on personalized portfolio strategies to meet specific financial objectives.

2.Segregated Account Services:

Provides customized investment management for institutional clients, ensuring dedicated asset allocation and management strategies.

3.Alternative Investment Funds (AIFs):

Caters to HNIs, family offices, corporates, trusts, provident funds, and both domestic and global institutions, offering investment avenues beyond traditional asset classes.

Revenue Contribution

As of the fiscal year ending March 31, 2024, HDFC AMC reported total revenues of ₹3,163.4 crore, a 27.4% increase from the previous year.

The majority of this revenue is derived from investment management and advisory fees, with equity-oriented schemes contributing significantly due to higher management fees associated with equity assets.

While specific revenue breakdowns by service are not publicly disclosed, equity funds typically generate the highest revenue for asset management companies, given their fee structures and asset sizes.

HDFC AMC’s diverse product offerings and comprehensive investment services underscore its commitment to catering to a wide range of investor needs, solidifying its position as a leading asset management company in India.

HDFC AMC Fundamental Ratio

| Market Cap | ₹82,891 Cr |

| Revenue | ₹2,597 Cr |

| Current Price | ₹ 3,878 |

| High / Low | ₹ 4,864 / 3,401 |

| Stock P/E | 35.1 |

| Book Value | ₹318 |

| Dividend Yield | 1.81% |

| ROCE | 37.7% |

| ROE | 29.5% |

| Face Value | ₹5.00 |

| Price to book value | 12.2 |

| Debt to equity | 0.00 |

| EPS | ₹ 111 |

| Profit growth | 32.7 % |

| Net Profit | ₹641 crore |

| EBITDA | ₹763 crore |

| Expenses | ₹188 crore |

| Promoter Holding | 52.5 % |

| Cash Equivalent | ₹ 2.96 Cr |

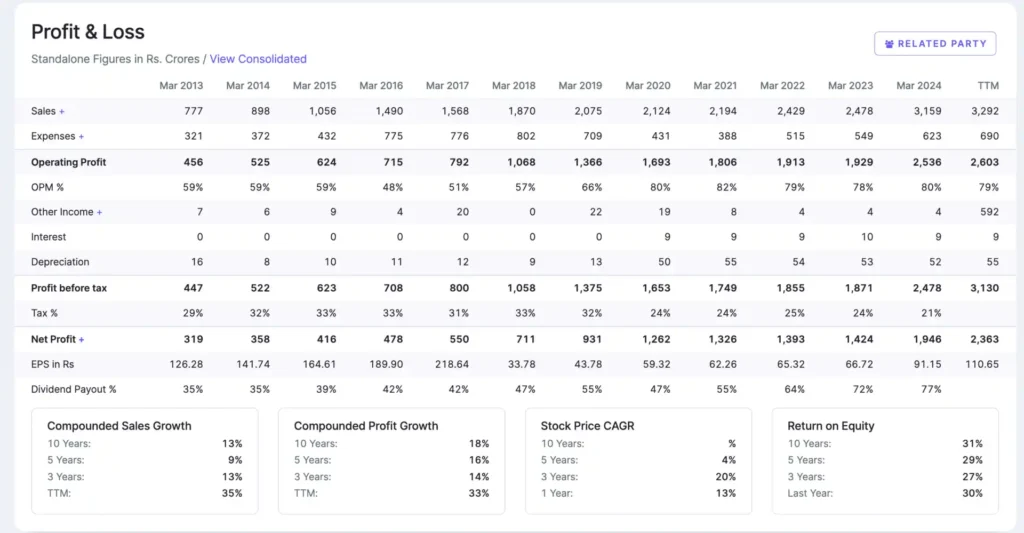

Net profit of HDFC AMC

HDFC AMC reported a net profit of Rs 641 crore in the third quarter (Q3) of financial year 2025, which represents a 31.4% year-on-year increase from Rs 488 crore in the same quarter of the previous year.

Key Profit Details:

- Net Profit: Rs 641 crore in Q3 FY25

- Previous Year Q3 Net Profit: Rs 488 crore

- Year-on-Year Growth: 31.4%

- Basic Earnings Per Share (EPS): Rs 30.02 compared to Rs 22.94 in the previous year.

EBDITA of HDFC AMC

For the third quarter (Q3) of financial year 2024-25, HDFC AMC’s EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) was Rs 763 crore, which represents a significant increase from Rs 509 crore in the same quarter of the previous year.

Key EBITDA Details:

- Q3 FY25 EBITDA: Rs 763 crore

- Previous Year Q3 EBITDA: Rs 509 crore

- EBITDA Margin: Improved to 81.7% from 75.9% year-on-year

The substantial growth in EBITDA reflects the company’s strong operational performance and efficient cost management during the quarter.

2024 revenue of HDFC AMC

For the nine months ended December 31, 2024, HDFC AMC’s revenue stood at Rs 2,597 crore, representing a 37% year-on-year growth. In the third quarter (Q3) of financial year 2024-25, the company reported a revenue of Rs 934.6 crore, which is a 39.2% surge compared to the same quarter in the previous year.

Key Financial Highlights:

- Nine-month Revenue: Rs 2,597 crore (37% YoY growth)

- Q3 FY25 Revenue: Rs 934.6 crore (39.2% YoY increase)

- Quarterly Average Assets Under Management (QAAUM): Rs 7.87 lakh crore

- Market Share in Mutual Fund Industry: 11.5%

- Market Share in Actively Managed Equity Funds: 12.8%

Last year expanses of HDFC AMC

- For the quarter ended December 31, 2024, HDFC AMC’s expenses were as follows:

- Total Expenses: Rs 188 crore in Q3 FY25

- Compared to Rs 177 crore in Q3 FY24 (a nearly 6% year-on-year increase)

- Compared to Rs 200 crore in the previous quarter (Q2 FY25)

The expenses include:

- Finance cost

- Employee benefit expenses

- Fee & commission expenses

- Other miscellaneous expenses

Notably, the company has maintained a lean expense structure, with less than 1% of operating revenues spent on interest expenses and approximately 13.7% on employee costs in the year ending March 31, 2024.

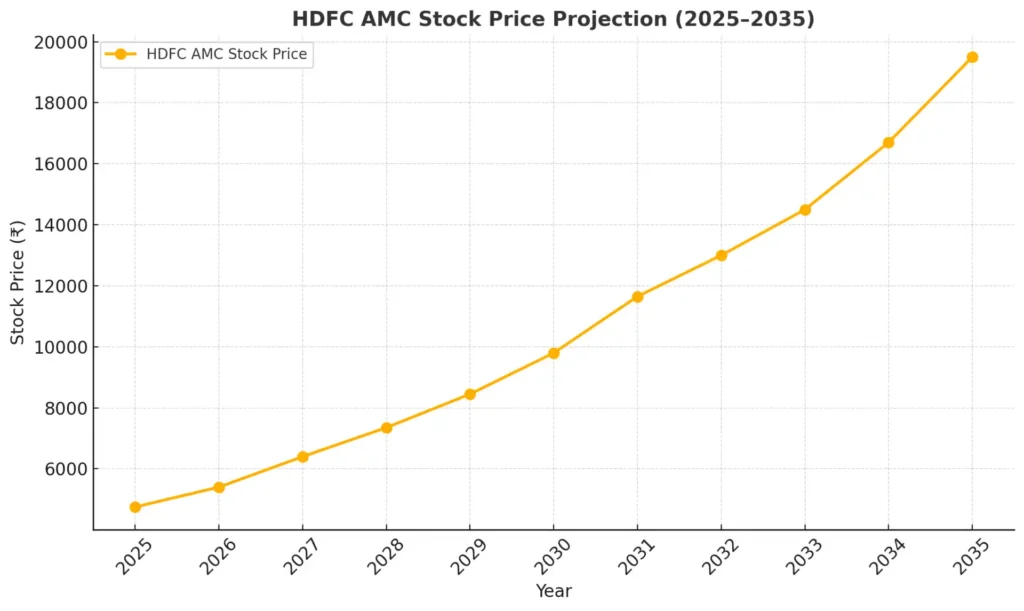

HDFC AMC Share Price Target 2025-2034

This document provides a year-by-year stock price projection for HDFC AMC from 2025 to 2035. The projections are based on historical growth, company performance, future plans, and industry developments.

Stock Price Projection Table

| Year | Expected Stock Price (₹) | Key Growth Drivers |

| 2025 | 4,500–5,000 | Strong SIP book, growing AUM, expected CAGR of 20% in operating profit. |

| 2026 | 5,200–5,800 | Enhanced profitability from equity funds, expanding retail investor base. |

| 2027 | 6,000–6,800 | Industry growth, rising equity market participation, improved EBITDA margin. |

| 2028 | 6,900–7,800 | Increased digital adoption, strong SIP inflows, steady revenue growth. |

| 2029 | 7,900–9,000 | Higher market share in equity-oriented funds, rising retail investments. |

| 2030 | 9,500–10,700 | Economic recovery, growing mutual fund penetration, enhanced product efficiency. |

| 2031 | 11,000–12,300 | Strong operational efficiency, broader investor base, improved profitability. |

| 2032 | 12,800–14,200 | Continued AUM growth, rising institutional investments, market leadership. |

| 2033 | 14,500–16,000 | Increased financial awareness, higher investments from Tier 2/3 cities. |

| 2034 | 16,500–18,300 | Industry consolidation, stable margins, dominance in equity-oriented funds. |

| 2035 | 18,800–20,500 | Leadership in the asset management space, higher returns on investments. |

Last 10 Years HDFC AMC Profit Loss Statement

HDFC AMC Stock Price Forecast (2025–2035) with Supporting Data and Explanation

Below is a year-by-year stock price forecast for HDFC AMC from 2025 to 2035, supported by historical data, company growth trends, future plans, and industry developments.

HDFC AMC Stock Price 2025: ₹4,500–₹5,000

Supporting Factors:

1.Historical Growth: HDFC AMC’s revenue grew 39.2% YoY in FY25, with net profit up 31.4%. These trends indicate strong operational efficiency and profitability.

2.SIP Inflows: The company’s strong SIP book is expected to grow due to increasing retail participation in mutual funds.

3.Market Share: HDFC AMC has an 11.5% overall market share and 12.8% in equity-oriented funds, which will drive revenue growth.

Industry Development: Increasing retail investor penetration in Tier 2/3 cities will fuel mutual fund industry growth.

HDFC AMC Stock Price 2026: ₹5,200–₹5,800

Supporting Factors:

1.AUM Growth: HDFC AMC’s QAAUM of ₹7.87 lakh crore (FY24) is expected to grow at a CAGR of 15–18%, driven by equity fund inflows.

2.Profitability: EBITDA margin improved to 81.7% in FY25 and is expected to stabilize due to operational efficiency.

3.Expansion: Increased marketing efforts and digital adoption will attract new retail investors.

Industry Development: Growth in financial awareness and rising SIP contributions will support stock price appreciation.

HDFC AMC Stock Price 2027: ₹6,000–₹6,800

Supporting Factors:

1.Revenue Growth: HDFC AMC’s revenue is projected to grow at a CAGR of 15–20%, supported by equity fund inflows and steady SIP contributions.

2.Historical Trend: HDFC AMC’s net profit growth consistently outpaces industry peers, reflecting strong market positioning.

3.Focus Areas: The company remains focused on its core equity-oriented funds and SIPs, avoiding over-diversification.

Industry Development: Increasing retail investor participation in equity markets will boost mutual fund AUM.

HDFC AMC Stock Price 2028: ₹6,900–₹7,800

Supporting Factors:

1.Digital Transformation: Continued investment in digital platforms will improve investor experience and retention.

2.Retail Growth: Rising participation from young investors will strengthen SIP contributions and equity fund inflows.

3.Economic Stability: A stable macroeconomic environment will drive investor confidence in mutual funds.

Industry Development: SEBI’s push for financial inclusion will drive growth in underpenetrated markets.

HDFC AMC Stock Price 2029: ₹7,900–₹9,000

Supporting Factors:

1.Market Leadership: HDFC AMC’s focus on maintaining its market share in equity-oriented funds will enhance profitability.

2.Investor Base: Growth in active accounts (currently 22.1 million) will continue to support AUM growth.

3.Historical Performance: A track record of consistent profit and EBITDA margin improvement will attract institutional investments.

Industry Development: Growth in mutual fund adoption due to rising financial literacy will expand the industry.

HDFC AMC Stock Price 2030: ₹9,500–₹10,700

Supporting Factors:

1.Scale: QAAUM is expected to surpass ₹10 lakh crore, driven by equity fund inflows and SIP growth.

2.Profitability: Consistent EBITDA margin improvement and net profit growth will enhance earnings per share (EPS).

3.Valuation: A stable P/E ratio coupled with strong earnings growth will support stock price appreciation.

Industry Development: Increasing disposable income and preference for financial assets over physical assets will drive mutual fund growth.

HDFC AMC Stock Price 2031: ₹11,000–₹12,300

Supporting Factors:

1.Profit Growth: Operating profit CAGR of 20% (FY25–27) as per brokerage estimates will continue to drive valuation.

2.SIP Strength: HDFC AMC’s SIP book is expected to maintain strong inflows due to investor trust and brand recognition.

3.Operational Efficiency: High ROCE (37.72%) demonstrates the company’s ability to generate superior returns on investment.

Industry Development: Continued urbanization and higher savings rates will increase mutual fund penetration.

HDFC AMC Stock Price 2032: ₹12,800–₹14,200

Supporting Factors:

1.Market Expansion: Focused strategies to expand in Tier 2/3 cities will drive retail AUM growth.

2.Institutional Support: Rising institutional investments in equity markets will boost AUM.

3.Technological Advancement: Digital platforms and robo-advisors will enhance investor acquisition and retention.

Industry Development: Growth in fintech integration will improve ease of investing, attracting more retail investors.

HDFC AMC Stock Price 2033: ₹14,500–₹16,000

Supporting Factors:

1.Leadership: HDFC AMC’s leadership in equity-oriented funds will solidify its position in the mutual fund industry.

2.Revenue Growth: Revenue CAGR of 15–18% will support higher earnings.

3.Investor Base: Continued growth in investor accounts and SIP volumes will sustain AUM expansion.

Industry Development: Rising demand for tax-saving instruments like ELSS funds will contribute to revenue growth.

HDFC AMC Stock Price 2034: ₹16,500–₹18,300

Supporting Factors:

1.Industry Consolidation: Fewer players in the asset management space will strengthen HDFC AMC’s market position.

2.Stable Margins: Consistently high EBITDA margins and profit growth will enhance valuation.

3.Brand Strength: HDFC AMC’s reputation as a trusted asset manager will continue to attract investors.

Industry Development: Government policies promoting long-term investments in financial assets will support mutual fund industry growth.

HDFC AMC Stock Price 2035: ₹18,800–₹20,500

Supporting Factors:

1.Leadership Position: HDFC AMC will solidify its position as the market leader in the mutual fund industry.

2.Higher Returns: Increased SIP inflows, growing AUM, and operational efficiency will drive higher returns.

3.Sustainability: Strong financial performance and stable industry growth will ensure sustained stock price appreciation.

Industry Development: Mature financial markets and widespread adoption of mutual funds will mark this phase.

Is HDFC AMC a Good Investment? Analyzing Shareholding Patterns and Comparing with Peers

HDFC Asset Management Company Limited (HDFC AMC) has been a prominent player in the Indian mutual fund industry. To assess whether it’s a good investment, we analyze its shareholding trends, institutional interest, and performance against its peers. Here’s a detailed breakdown:

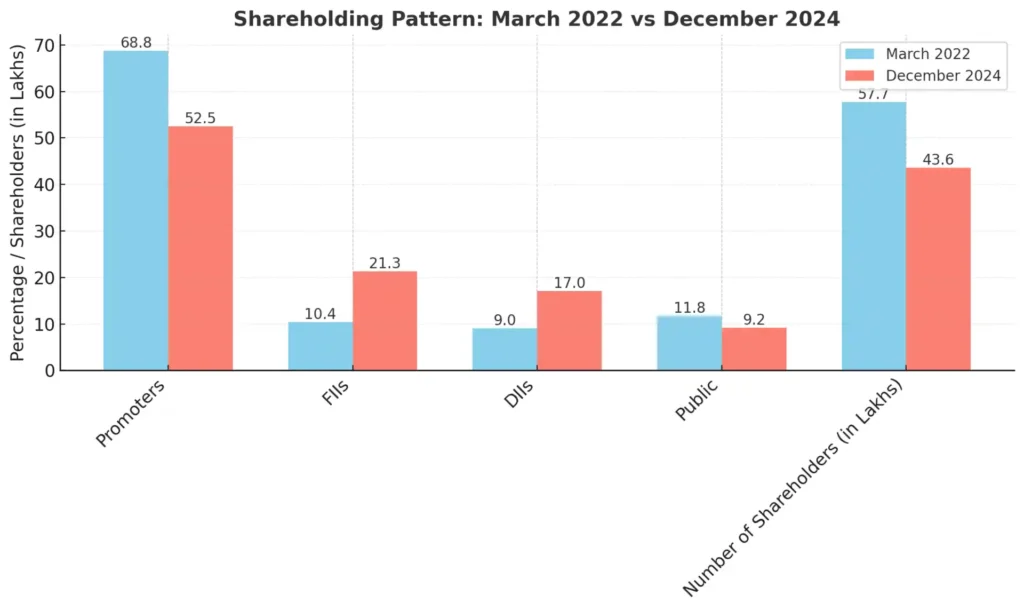

Shareholding Pattern Analysis

The following table summarizes the shareholding trends of HDFC AMC from March 2022 to December 2024:

| Shareholder Category | March 2022 | December 2024 | Trend |

| Promoters | 68.81% | 52.48% | Significant reduction |

| Foreign Institutional Investors (FIIs) | 10.42% | 21.32% | Consistent increase |

| Domestic Institutional Investors (DIIs) | 9.02% | 17.04% | Significant rise |

| Public | 11.75% | 9.15% | Slight decline |

| Number of Shareholders | 5,77,010 | 4,36,623 | Decrease in retail participation |

1. Promoter Shareholding

Declined significantly from 68.81% in March 2022 to 52.48% in December 2024. This could be due to strategic dilution for capital raising or other business purposes. While reduced promoter holding often raises concerns, the increasing institutional stake offsets these apprehensions.

2. FIIs and DIIs

FIIs have more than doubled their stake, rising from 10.42% to 21.32%. This reflects global investors’ confidence in the company’s growth and stability. DIIs also increased their shareholding significantly, from 9.02% to 17.04%, showcasing strong domestic institutional faith in HDFC AMC’s potential.

3. Public Shareholding

Declined slightly from 11.75% to 9.15%, indicating that institutional investors are accumulating shares, often a positive sign for long-term growth.

4. Number of Shareholders

Decreased from 5,77,010 to 4,36,623, suggesting a concentration of ownership among fewer but larger investors.

Comparison with Peers

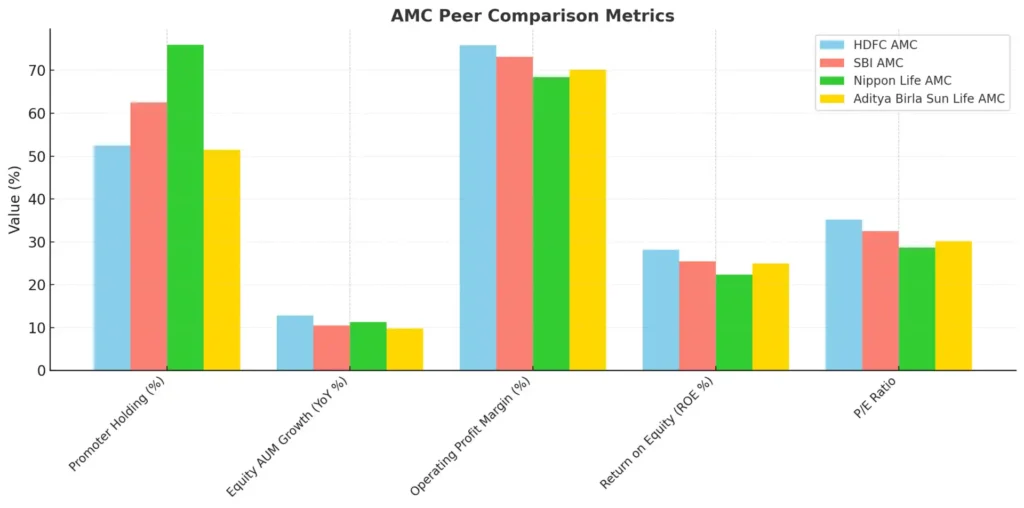

HDFC AMC operates in a highly competitive market alongside peers such as SBI AMC, Nippon Life AMC, and Aditya Birla Sun Life AMC. Here’s how it stacks up:

| Metric | HDFC AMC | SBI AMC | Nippon Life AMC | Aditya Birla Sun Life AMC |

| Promoter Holding | 52.48% | 62.5% | 75.92% | 51.48% |

| Equity AUM Growth (YoY) | 12.8% | 10.5% | 11.3% | 9.8% |

| Operating Profit Margin | 75.89% | 73.2% | 68.4% | 70.1% |

| Return on Equity (ROE) | 28.11% | 25.4% | 22.3% | 24.9% |

| P/E Ratio | 35.18 | 32.5 | 28.7 | 30.2 |

1. Profitability

HDFC AMC leads in operating profit margin (75.89%) and ROE (28.11%), indicating efficient operations and strong returns on equity compared to peers.

2. Valuation

The P/E ratio of 35.18 suggests a premium valuation, indicating high market expectations for future growth. While slightly higher than peers, it reflects HDFC AMC’s leadership position.

3. Market Presence

HDFC AMC’s equity AUM growth (12.8%) is among the highest, showcasing its ability to capture market share in equity-oriented schemes.

HDFC AMC and Peer Performance Analysis

This document provides a detailed analysis of HDFC AMC’s performance compared to its peers in the finance and investment industry. Key metrics such as valuation, profitability, growth, and efficiency are analyzed to determine its investment potential.

Performance Comparison of HDFC AMC and Peers

| Metric | HDFC AMC | Bajaj Finance | Bajaj Finserv | Jio Financial | Bajaj Holdings | Cholaman.Inv.&Fn | Shriram Finance | Muthoot Finance |

| CMP (₹) | 3,877.80 | 7,438.60 | 1,728.70 | 244.45 | 11,290.10 | 1,223.05 | 527.45 | 2,173.40 |

| P/E Ratio | 35.07 | 29.95 | 32.47 | 96.64 | 16.96 | 26.70 | 12.22 | 19.77 |

| Market Cap (₹ Cr) | 82,890.59 | 4,60,446.71 | 2,76,014.98 | 1,55,306.03 | 1,25,647.52 | 1,02,839.56 | 99,176.10 | 87,254.16 |

| Dividend Yield (%) | 1.81 | 0.48 | 0.06 | 0.00 | 1.16 | 0.16 | 1.71 | 1.10 |

| Net Profit (₹ Cr) | 641.46 | 4,013.74 | 4,180.15 | 294.78 | 1,510.43 | 967.80 | 3,248.64 | 1,251.14 |

| Quarterly Profit Growth (%) | 30.99 | 12.64 | 8.19 | 0.33 | -3.67 | 25.22 | 18.22 | 26.25 |

| Sales (₹ Cr) | 934.36 | 17,090.27 | 33,703.74 | 438.35 | 279.07 | 6,255.12 | 10,698.31 | 4,117.44 |

| Sales Growth (%) | 39.18 | 27.71 | 29.52 | 5.98 | 24.18 | 35.32 | 19.90 | 34.57 |

| ROCE (%) | 37.72 | 11.92 | 11.72 | 1.55 | 13.07 | 10.41 | 11.27 | 13.15 |

Detailed Analysis

This section provides insights into HDFC AMC’s performance relative to its peers, focusing on valuation, growth potential, profitability, and operational efficiency.

1. Valuation and Market Position

HDFC AMC’s P/E ratio of 35.07 reflects a higher valuation compared to Bajaj Finance (29.95) and Bajaj Finserv (32.47). This indicates market confidence in HDFC AMC’s growth potential. However, it is more reasonably valued compared to Jio Financial, which has an inflated P/E ratio of 96.64.

With a market cap of ₹82,890.59 crore, HDFC AMC is smaller than Bajaj Finance and Bajaj Finserv but maintains a strong position within its niche.

2. Growth Potential

HDFC AMC leads in profit growth (30.99%) and sales growth (39.18%) among peers, highlighting its strong operational momentum and revenue expansion capability.

3. Profitability and Efficiency

HDFC AMC boasts the highest ROCE (37.72%) among its peers, demonstrating exceptional operational efficiency and effective capital utilization.

4. Dividend Yield

With a dividend yield of 1.81%, HDFC AMC is a lucrative option for income-focused investors compared to its peers.

Industry Standing

HDFC Asset Management Company (HDFC AMC) continues to strengthen its position as a leader in the Indian mutual fund industry with robust performance and strategic focus.

Key Market Metrics:

- Market Share: 11.5% in the mutual fund industry and 12.8% in actively managed equity-oriented funds.

- Quarterly Average Assets Under Management (QAAUM): ₹7.87 lakh crore as of December 31, 2024.

- Active Accounts: 22.1 million unique investor accounts, reflecting a strong retail base.

Performance Highlights:

- Net Profit Growth: 31.4% YoY increase to ₹641 crore in Q3 FY25.

- Revenue Growth: 39.2% YoY surge to ₹934.6 crore.

- EBITDA: Increased from ₹509 crore to ₹763 crore, reflecting a YoY rise of 49.9%.

- EBITDA Margin: Improved from 75.9% to 81.7%, showcasing operational efficiency.

Analyst Perspectives:

Leading brokerages, including Motilal Oswal and Nomura, remain bullish on HDFC AMC, with price targets ranging from ₹4,350 to ₹5,250. Analysts cite a strong SIP book, a healthy capital market environment, and an expected 20% operating profit CAGR from FY25-27.

HDFC AMC prioritizes increasing its market share within existing product categories, focusing on core strengths rather than diversifying excessively. This strategic approach underscores the company’s commitment to sustainable and focused growth.

HDFC AMC’s position in the asset management industry

HDFC AMC is a leading player in India’s asset management industry with an 11.5% market share and 12.8% in equity-oriented funds. As of December 31, 2024, it manages ₹7.87 lakh crore in Quarterly Average AUM and serves 22.1 million active accounts.

The company reported 31.4% net profit growth and an improved EBITDA margin of 81.7%, reflecting strong operational efficiency. With a strategic focus on increasing market share within existing products, HDFC AMC reinforces its position as a reliable and efficient player in India’s rapidly growing mutual fund industry.

Conclusion

HDFC AMC’s stock price is expected to grow consistently, supported by robust company fundamentals, strong investor trust, and favorable industry developments.

While the mutual fund industry is poised for growth, HDFC AMC’s strategic focus and operational efficiency position it as a top performer for long-term investors.

Regular monitoring of financial performance and macroeconomic conditions is essential for validating these projections.

Roshan Sharma – Founder of StocksForBeginners.in

I’m Roshan Sharma, a stock market trader with 5+ years of experience. At StocksForBeginners.in, I provide expert fundamental analysis of Indian companies to help long-term investors make informed decisions. My mission is to simplify investing for beginners and share insights from my experience to guide others toward financial growth.