Indian Railway Catering and Tourism Corporation Limited (IRCTC) is a Mini Ratna (Category-I) Central Public Sector Enterprise under the Ministry of Railways, Government of India. It is the only authorized entity for online railway ticket booking, catering services, and packaged drinking water (Rail Neer) in Indian Railways. IRCTC has become a key player in the travel and tourism industry, offering a wide range of services, including e-ticketing, tourism packages, hospitality services, and bottled water.

Key Business Segments

1.Internet Ticketing: This is IRCTC’s largest revenue segment, contributing significantly to its overall earnings. IRCTC handles more than 80% of the reserved railway ticket bookings in India.

2.Catering Services: IRCTC manages catering operations on Indian Railways, including on-board catering, e-catering, and food plazas at stations.

3.Rail Neer (Packaged Drinking Water): IRCTC produces and distributes bottled water across railway stations and trains. It is expanding its production capacity to meet increasing demand.

4.Tourism Services: The company offers diverse tourism packages, including domestic and international tours, luxury train services, and pilgrimage packages like Bharat Gaurav trains.

FY 2023-24 Financial Performance

- Revenue: ₹4,270 crore, a growth of nearly 20% YoY.

- EBITDA: ₹1,630 crore, showcasing strong operational efficiency with margins of 38%.

- Net Profit: ₹1,170 crore, indicating solid profitability and a focus on cost management.

- Dividend: IRCTC has consistently rewarded shareholders with dividends, reflecting its strong cash flow and profitability.

Current Fundamental Ratios of IRCTC

| Market Cap | ₹ 63,748 Cr |

| Enterprise Value | ₹ 61,485.35 Cr |

| No. of share | 80 Cr |

| P/E | 53.13 |

| P/B | 18.09 |

| Face value | ₹ 2 |

| Dividend Yield (Last Year) | 0.81 % |

| Book Value | ₹44.04 |

| Debt | ₹0 |

| EPS | ₹15 |

| ROE | 38.93 % |

| ROCE | 53.08% |

| Profit growth (1 year) | 10.48 % |

| Sales growth | -11.13% |

| Cash | ₹ 2,262.65 Cr |

| Debt to Equity | 0 |

| Promoter’s Holding | 62.4 % |

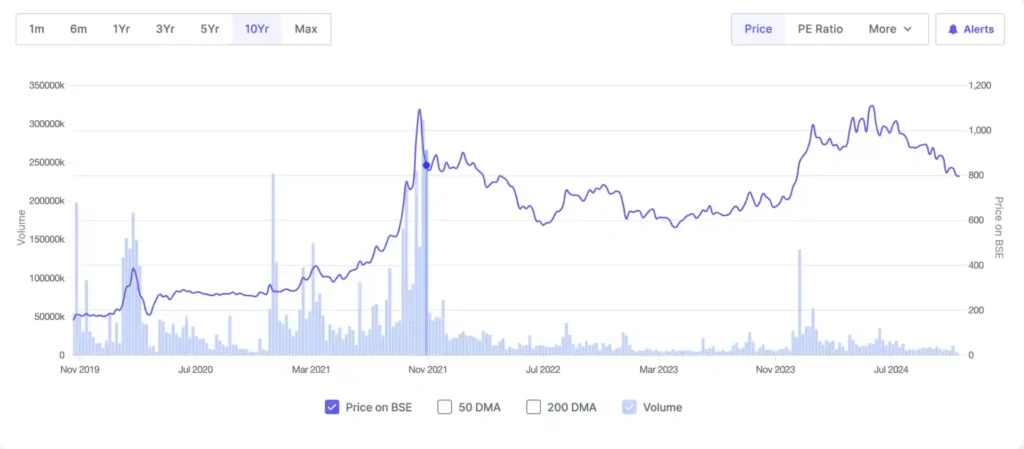

IRCTC Share Price Target Forecast (2024-2034)

| Year | IRCTC Share Price Target |

| IRCTC Share Price Target 2024 | ₹ 810.70 |

| IRCTC Share Price Target 2025 | ₹830 |

| IRCTC Share Price Target 2026 | ₹880 |

| IRCTC Share Price Target 2027 | ₹960 |

| IRCTC Share Price Target 2028 | ₹1,050 |

| IRCTC Share Price Target 2029 | ₹1,150 |

| IRCTC Share Price Target 2030 | ₹1,270 |

| IRCTC Share Price Target 2031 | ₹1,400 |

| IRCTC Share Price Target 2032 | ₹1,550 |

| IRCTC Share Price Target 2033 | ₹1,720 |

| IRCTC Share Price Target 2034 | ₹1,900 |

Last 5 years Profit-Loss Statement Analysis

| Particulars | 2024 (₹ Lakhs) | 2023 (₹ Lakhs) | 2022 (₹ Lakhs) | 2021 (₹ Lakhs) | 2020 (₹ Lakhs) |

| Revenue from Operations | 4,27,018 3 | 3,66,190 | 2,38,119 | 1,41,879 | 2,27,548 |

| Other Income | 8,469 | 6,782 | 4,632 | 7,805 | 7,805 |

| Total Revenue | 4,35,487 | 3,72,972 | 2,42,751 | 1,49,684 | 2,35,354 |

| Cost of Materials Consumed | 12,445 | 10,992 | 9,372 | 10,993 | 10,993 |

| Purchase of Stock-in-Trade | 3,582 | 2,857 | 3,005 | 2,858 | 2,858 |

| Employee Benefit Expense | 27,332 | 24,401 | 21,093 | 24,401 | 24,401 |

| Depreciation and Amortization Expense | 5,722 | 5,373 | 4,899 | 4,628 | 3,994 |

| Finance Costs | 606 | 625 | 727 | 727 | 727 |

| Other Expenses | 1,04,500 | 82,978 | 78,946 | 66,219 | 79,680 |

| Total Expenses | 2,88,008 | 2,33,509 | 1,71,750 | 1,15,790 | 1,16,930 |

| Profit Before Tax | 1,49,604 | 1,35,401 | 66,369 | 26,080 | 74,535 |

| Tax Expense | 38,497 | 34,873 | 19,942 | 7,452 | 21,678 |

| Net Profit (PAT) | 1,11,108 | 1,00,588 | 66,369 | 18,990 | 52,857 |

| Earnings Per Share (Basic, ₹) | 13.89 | 12.57 | 8.3 | 11.87 | 33.04 |

| Total Comprehensive Income | 1,11,138 | 1,00,809 | 66,807 | 19,313 | 52,488 |

Revenue Growth:

IRCTC has demonstrated consistent growth in revenue from operations, with a significant recovery post-pandemic (2021 onwards). The revenue growth rate for 2024 was about 17%, driven mainly by increased demand in internet ticketing and catering services.

The CAGR for revenue from 2020 to 2024 is approximately 15%, highlighting strong operational performance and market expansion .

Profit Margins:

The company’s profit margins have remained strong, with Net Profit increasing from ₹52,857 lakhs in 2020 to ₹1,11,108 lakhs in 2024. This indicates an effective cost management strategy and higher operational efficiency.

IRCTC maintained a healthy EBITDA margin of around 38% in 2024, showcasing its strong operational leverage .

Expenses:

Total expenses increased in line with revenue growth, but the company managed to keep its employee and material costs under control. Depreciation and finance costs have remained stable, reflecting efficient asset management.

The rise in other expenses in 2024 was due to increased service offerings, including Vande Bharat trains and new tourism packages .

Tax and Earnings:

The tax expense has shown an upward trend due to increased profitability, but the effective tax rate has been well-managed, ensuring a higher post-tax income per share (EPS) have shown strong recovery, particularly after the impact of COVID-19 in 2021, highlighting improved shareholder returns .

Shareholding Pattern

Promoters

Declined from 67.4% in Dec 2021 to 62.4% from Sep 2022 onwards.

Indicates dilution of promoter stake, potentially through an Offer for Sale (OFS) by the government.

The decline in promoter (Government of India) holding suggests strategic stake dilution, likely through an Offer for Sale (OFS). This is common for public sector enterprises as part of the government’s disinvestment strategy.

While this may raise concerns about reduced promoter commitment, it also increases the stock’s free float, improving liquidity and making it more attractive for large institutional investors.

FIIs (Foreign Institutional Investors)

Initially decreased to 5.81% in Sep 2022 but rebounded to 8.08% in Mar 2024.

Reflects growing confidence of foreign investors, signaling positive sentiment towards the company’s growth prospects.

DIIs (Domestic Institutional Investors)

Significant increase from 4.69% in Dec 2021 to 13.92% in Sep 2024.

Suggests strong interest from domestic mutual funds and institutional investors, highlighting confidence in the long-term prospects of IRCTC.

Rise in Institutional Ownership:

The steady increase in holdings by both FIIs and DIIs indicates growing confidence in IRCTC’s business model and future growth prospects. Institutional investors typically conduct extensive due diligence, and their increased stake is a positive signal for retail investors.

Public

Shareholding has reduced from 20.86% in Dec 2021 to 16.14% in Sep 2024.

Indicates a shift towards higher institutional ownership, which can be seen as a sign of stability and reduced volatility.

The reduction in public shareholding may indicate that retail investors are consolidating their positions or that institutional investors are acquiring more shares, reducing the overall share available to the general public.

This could lead to reduced short-term volatility, as institutional investors tend to hold stocks for longer periods.

Company Past Performance

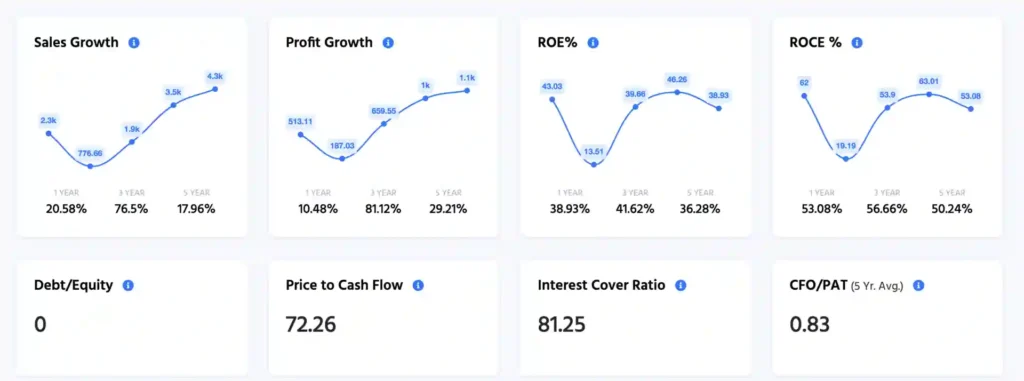

1. Sales Growth:

• 1-Year Growth: 20.58%

• 3-Year Growth: 76.5%

• 5-Year Growth: 17.96%

Analysis:

The sales growth indicates strong revenue expansion, particularly noticeable in the 3-year growth figure of 76.5%, which shows a significant recovery post-pandemic.

The 1-year growth of 20.58% suggests a consistent upward trend, driven by increased demand for ticketing services, catering, and tourism packages.

2. Profit Growth:

• 1-Year Growth: 10.48%

• 3-Year Growth: 81.12%

• 5-Year Growth: 29.21%

Analysis:

The profit growth reflects strong operational performance, with notable improvement over the 3-year period (81.12%). This suggests efficient cost management and enhanced profitability, especially after the pandemic downturn.

The 10.48% growth in the last year shows steady profitability despite potential macroeconomic challenges.

3. Return on Equity (ROE%):

• 1-Year ROE: 38.93%

• 3-Year ROE: 41.62%

• 5-Year ROE: 36.28%

Analysis:

The high ROE indicates efficient utilization of equity capital and strong profitability. The 1-year ROE of 38.93% is impressive and suggests that IRCTC is generating substantial returns for its shareholders.

Consistent ROE levels above 35% over the last 5 years demonstrate the company’s strong business model and operational efficiency.

4. Return on Capital Employed (ROCE%):

• 1-Year ROCE: 53.08%

• 3-Year ROCE: 56.66%

• 5-Year ROCE: 50.24%

Analysis:

The high ROCE indicates effective utilization of the company’s capital in generating profits. The 3-year average of 56.66% suggests excellent capital efficiency, which is well above industry norms (typically 20-30% for similar companies).

A decline in the 5-year ROCE average to 50.24% still reflects strong performance but may indicate increased capital expenditure or investments for future growth.

5. Debt/Equity Ratio:

• Value: 0

Analysis:

IRCTC remains a debt-free company, which is a significant advantage. This enhances financial stability, reduces risk, and provides the company with flexibility for future growth investments.

The absence of debt also improves the company’s profitability, as there are no interest expenses impacting earnings.

6. Price to Cash Flow (P/CF):

• Value: 72.26

Analysis:

The high P/CF ratio suggests that the stock may be overvalued relative to its cash flow generation. Investors are likely paying a premium for the company’s strong market position and growth prospects.

While a high P/CF can indicate strong investor confidence, it also raises concerns about potential overvaluation, warranting caution for new investors.

7. Interest Cover Ratio:

• Value: 81.25

Analysis:

The interest cover ratio measures the company’s ability to meet its interest obligations. A value of 81.25 is extremely high, indicating strong financial health and excellent capacity to service any potential debt.

This ratio reinforces the company’s debt-free status and strong cash flow generation.

8. CFO/PAT (Cash Flow from Operations/Profit After Tax):

• 5-Year Average: 0.83

Analysis:

A CFO/PAT ratio of 0.83 suggests that a substantial portion of the company’s profits are being converted into cash flow. This is a healthy indicator of cash flow efficiency.

It shows that the company is effectively managing its working capital and converting earnings into cash, which is crucial for sustaining operations and funding future growth.

Risks and Challenges

Regulatory Risks: As a government-backed entity, IRCTC is subject to stringent regulations. Changes in government policies, tariffs, or the introduction of private players in the railway sector could adversely affect its operations and profitability.

Dependency on Indian Railways: A significant portion of IRCTC’s revenue is derived from services related to Indian Railways. Any policy changes or operational disruptions within Indian Railways can directly impact IRCTC’s performance.

Competition from Private Players: The potential entry of private entities into sectors dominated by IRCTC, such as catering and online ticketing, could erode its market share and profitability.

Technological Challenges: With the rapid evolution of technology, IRCTC must continually upgrade its digital platforms to meet customer expectations and fend off competition from tech-savvy private players.

Data Privacy Concerns: Handling vast amounts of passenger data necessitates stringent data protection measures. Any data breaches or misuse could lead to legal challenges and tarnish the company’s reputation.

Future Goals and Growth Prospects

Despite these challenges, IRCTC has outlined strategic initiatives to drive future growth:

Diversification of Services: IRCTC plans to expand into new ticketing segments and payment solutions while maintaining its leadership in mass rail tourism. This includes foraying into bus booking services and exploring other travel-related offerings.

Enhancement of Digital Platforms: Investing in technology to improve user experience on its online platforms is a priority. This includes upgrading the website and mobile applications to offer seamless booking and payment experiences.

Expansion of Tourism Services: Leveraging India’s rich cultural heritage, IRCTC aims to introduce more specialized tour packages and luxury train experiences to attract both domestic and international tourists.

Collaboration with Private Players: To enhance service quality and efficiency, IRCTC is exploring partnerships with private entities, especially in areas like catering and onboard services.

Sustainability Initiatives: Aligning with global trends, IRCTC is focusing on sustainable practices, including eco-friendly catering options and reducing the carbon footprint of its operations.

IRCTC Growth Outlook

Analysts maintain a positive outlook on IRCTC’s growth trajectory:

• Earnings Growth: Projected at 17.3% per annum.

• Revenue Growth: Expected at 10.7% per annum.

• EPS Growth: Anticipated at 17.1% per annum.

• Return on Equity: Forecasted to be 30% in three years.

Roshan Sharma – Founder of StocksForBeginners.in

I’m Roshan Sharma, a stock market trader with 5+ years of experience. At StocksForBeginners.in, I provide expert fundamental analysis of Indian companies to help long-term investors make informed decisions. My mission is to simplify investing for beginners and share insights from my experience to guide others toward financial growth.