JSW Infrastructure is India’s second-largest private port operator, with a handling capacity of 170 MTPA, targeting 400 MTPA by FY2030. It operates 10 ports and terminals across India and internationally, including a liquid storage terminal in Fujairah, UAE.

The company is diversifying its revenue base, with 40% of cargo from third-party customers and a robust growth strategy focusing on brownfield expansions, acquisitions, greenfield projects, and sustainability.

Post-IPO in 2023, which raised ₹2,800 crore, JSW Infra significantly reduced its net debt, enhancing its financial flexibility. It reported ₹4,032 crore in revenue and ₹1,161 crore in profit (FY24).

Strategically positioned with deep-draft ports, it is well-placed to capitalize on India’s infrastructure growth and rising cargo demand.

JSW Infra’s five-pronged growth strategy aims to strengthen its position in the infrastructure sector:

- Pursuing brownfield expansions to enhance existing port capacities.

- Expanding its third-party customer base, shifting from a primarily captive cargo focus.

- Exploring acquisition opportunities to consolidate its position, including PNP Port and a liquid storage terminal in Fujairah.

- Investing in greenfield projects, such as the Keni Port in Karnataka and a dry bulk terminal in Tuticorin.

- Focusing on sustainable business growth, aligning with India’s net-zero and infrastructure modernization goals .

Sectoral Contribution and Competitive Advantage

1.Industry Leader: Positioned as a pioneer in the modernization of port infrastructure, integrating mechanized operations with multi-modal evacuation channels.

2.Deep-Draft Advantage: Most of its ports and terminals are designed for direct berthing of large vessels, providing a competitive edge in handling global cargo flows .

3.Sustainability Commitments: Targets net-zero emissions by 2050, with investments in low-carbon technologies and operational efficiency improvements.

Financial Strength of JSW Infra

Demonstrates robust financial health, with ₹4,032 crore in total income (FY24) and a net profit of ₹1,161 crore, reflecting strong profitability and growth .

Reduced net debt significantly from ₹2,216 crore (FY23) to ₹65 crore (FY24) post-IPO, enabling it to pursue both organic and inorganic growth .

Importance of JSW Infra in India’s infrastructure sector

JSW Infrastructure plays a crucial role in India’s infrastructure sector by enhancing the efficiency and capacity of the country’s port and logistics network. Key contributions include:

1.Boosting Trade and Cargo Handling: As India’s second-largest private port operator, JSW Infra handles 170 MTPA of cargo, facilitating 95% of the nation’s trade by volume and contributing significantly to economic growth.

2.Strategic Assets for Connectivity: Its 10 ports and terminals on India’s eastern and western coasts, with advanced multi-modal evacuation systems, support industrial supply chains and reduce logistics costs.

3.Driving Growth and Sustainability: The company’s focus on greenfield and brownfield expansions aligns with the government’s infrastructure vision, including Gati Shakti and Sagarmala initiatives, to enhance connectivity and modernize port infrastructure.

4.Economic Multiplier: By increasing third-party cargo to 40%, JSW Infra fosters diverse economic activity, supporting the manufacturing and energy sectors while targeting a 400 MTPA capacity by FY2030.

5.Global Competitiveness: Its deep-draft ports and mechanized handling make India’s ports globally competitive, positioning JSW Infra as a key player in the nation’s journey to become a global trade hub.

JSW Infrastructure Overview

JSW Steel, part of the larger JSW Group, has a rich history and significant operations in the steel industry.

JSW Steel was founded in 1982. It started as Jindal Iron and Steel Company (JISCO) after the Jindal Group acquired Piramal Steel Limited and established its first steel plant in Vasind, Maharashtra.

The headquarters of JSW Steel is located in Bandra East, Mumbai, Maharashtra, India.

JSW Infra Core Operations

JSW Steel primarily operates in the steel industry, focusing on the production of various steel products. Its operations include:

- Manufacturing: JSW Steel has multiple manufacturing facilities across India, with significant plants in Karnataka and Maharashtra.

- Product Range: The company produces hot-rolled and cold-rolled steel products, coated products, and special steel products for various sectors including construction and automotive.

- Innovation: JSW Steel emphasizes technological advancement through collaborations, such as its partnership with Japan’s JFE Steel Corporation for producing high-value special steel products.

In addition to steel production, JSW Group is involved in other sectors such as energy, infrastructure, cement, and paints, further expanding its operational footprint globally.

Business focus: port development, integrated logistics, SEZs, and industrial parks.

Main Business of JSW Infra:

Port Development: Operates 10 ports and terminals with a capacity of 170 MTPA, targeting 400 MTPA by FY2030.

Integrated Logistics: Multi-modal evacuation systems (rail, road, conveyor) to enhance cargo movement.

SEZs and Industrial Parks: Supports industries with efficient supply chain solutions and connectivity.

Key Achievements Of JSW Infra:

IPO Success: Raised ₹2,800 crore in 2023, reducing debt and funding expansions.

Third-Party Cargo Growth: Increased share to 40% of total volumes in FY2024.

Global Expansion: Added 5 MTPA liquid storage capacity in Fujairah, UAE.

Sustainability: Targeting net-zero emissions by 2050 with green energy initiatives.

JSW Infra Market Position:

- India’s second-largest private port operator.

- Leader in deep-draft port operations, handling large vessels.

- Key player in India’s Sagarmala and Gati Shakti infrastructure initiatives.

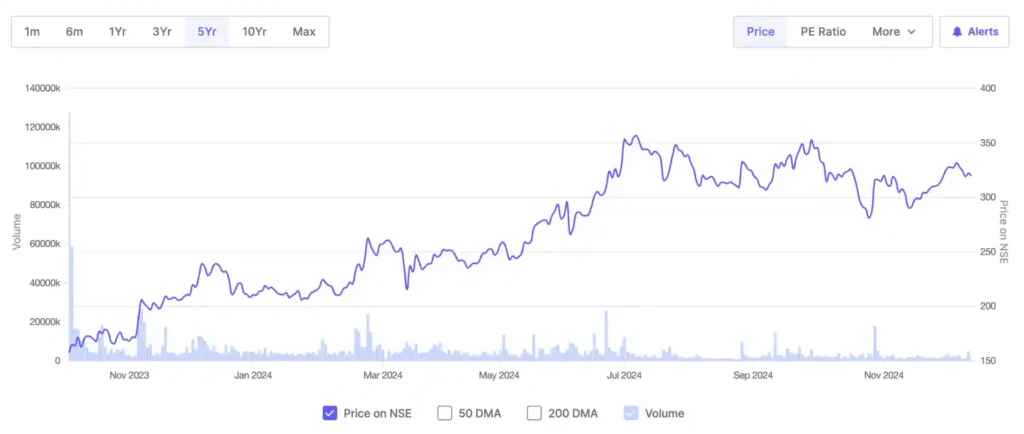

JSW Infra Current Market Performance (2024)

JSW Infrastructure has shown notable performance metrics in the stock market, reflecting its position in the Port & Port Services sector. Here’s a summary of its current stock performance:

Stock Performance Summary

| Matrices | Data |

| Current Share Price | ₹319.85(as of December 16, 2024) |

| Market Capitalization | ₹65,131.55 Crores |

| P/E Ratio | 52.50 |

| P/B Ratio | 7.89 |

| Price/Sales Ratio | 13.38 |

| Dividend Yield | 0.18% per annum |

Performance Over Time

| 1 Day Return | -1.59% |

| 1 Month Return | 5.28% |

| 3 Month Return | -2.34% |

| 1 Year Return | 34.15% |

| 3 Year Return | 98.66% |

Additional Ratios (FY 2024)

| Return on Equity (ROE) | 5.98% |

| Return on Capital Employed (ROCE) | 7.54% |

| Return on Assets (ROA) | 3.44% |

| Interest Coverage Ratio | 2.46 |

These metrics indicate a mixed performance with positive long-term returns, although recent trends show some volatility in the short term.

JSW Infra Recent Financial Performance

| Total Revenue | ₹4,032 crore (20% YoY growth) |

| EBITDA | ₹2,234 crore(24% YoY growth) |

| Net Profit | ₹1,161 crore (55% YoY growth) |

| Basic Earnings per Share (EPS) | ₹6.01 (up from ₹4.12 in FY2023) |

| Net Debt | ₹65 crore (reduced (-98.5%) significantly from ₹4,376 crore in FY2023) |

| Capacity Utilization | 61% |

| Cargo Volume Handled | 106 million tonnes (15% YoY growth) |

| Third-Party Cargo Share | 40% of total volumes (up from 33% in FY2023) |

Peer Comparison of JSW Infrastructures

JSW Infrastructure’s performance can be assessed by comparing its key financial metrics with those of its peers in the port services sector, including Adani Ports and Gujarat Pipavav Port. Here’s a detailed comparison:

| Company | JSW Infrastructure Ltd | Adani Ports & Special Economic Zone Ltd | Gujarat Pipavav Port Ltd |

| Current Price (₹) | 327.25 | 1,199.95 | 183.60 |

| Market Cap (₹ Cr) | 68,723 | 271,972 | 9,343 |

| P/E Ratio | 52.50 | 103.78 | 21.77 |

| P/B Ratio | 7.89 | 5.49 | 4.44 |

| Dividend Yield (%) | 0.18 | 0.48 | 3.98 |

| Net Profit Margin (%) | 8.59 | 31.74 | 39.69 |

| Revenue Growth (%) | 18.04 | 28.00 | -10.12 |

| Net Profit Growth(%) | 55(YoY) | 50 | N/A |

Performance Analysis

Market Capitalization: JSW Infrastructure has a market cap of ₹68,723 Crores, which is significantly lower than Adani Ports (₹271,972 Crores) but higher than Gujarat Pipavav Port (₹9,343 Crores). This suggests that while JSW is a major player, it still trails behind the largest competitor in the sector.

P/E Ratio: The P/E ratio of JSW Infrastructure is relatively high at 52.50, indicating that investors are willing to pay a premium for its earnings compared to Gujarat Pipavav’s low P/E of 21.77 and Adani Ports’ higher P/E of 103.78. A high P/E can imply that the market expects future growth.

P/B Ratio: JSW’s P/B ratio stands at 7.89, which is higher than both peers, suggesting that the stock may be overvalued relative to its book value compared to its competitors.

Dividend Yield: JSW Infrastructure offers a low dividend yield of 0.17%, significantly lower than Gujarat Pipavav’s attractive yield of 3.98% and Adani Ports’ yield of 0.48%. This may affect income-focused investors.

Net Profit Margin: JSW’s net profit margin of 8.59% is lower than Gujarat Pipavav’s impressive margin of 39.69% and Adani Ports’ margin of 31.74%, indicating less efficiency in converting revenue into actual profit.

JSW Infra Key Financial Metrics Comparison

Revenue Growth:

JSW Infrastructure reported a revenue growth of 18.04%, which is solid but lower than Adani Ports’ impressive 28% growth.

Gujarat Pipavav Port experienced a decline of 10.12%, indicating significant challenges in its operations.

Net Profit Growth:

Adani Ports achieved a remarkable net profit growth of 50%, showcasing strong operational efficiency and market demand.

Data for JSW Infrastructure and Gujarat Pipavav Port regarding net profit growth is not available, making it difficult to assess their profitability trends directly.

Market Capitalization and Valuation Ratios:

JSW has a market cap of ₹68,723 Crores, significantly smaller than Adani Ports at ₹271,972 Crores but larger than Gujarat Pipavav’s ₹9,343 Crores.

The P/E ratio for JSW (52.50) indicates that investors are willing to pay a premium for its earnings compared to Gujarat Pipavav (21.77) but less than Adani Ports (103.78), suggesting mixed market sentiment.

Profitability Ratios:

JSW’s net profit margin stands at 8.59%, which is considerably lower than Adani Ports’ margin of 31.74% and also below Gujarat Pipavav’s margin of 39.69%.

Current Market Scenario

In the current market scenario, JSW Infrastructure is performing reasonably well with positive revenue growth; however, it lags behind Adani Ports in terms of profitability and overall market capitalization. The company’s lower net profit margin indicates potential inefficiencies or higher costs relative to its peers.

Future Market Scenario

The Indian port infrastructure market is expected to grow robustly, with forecasts suggesting a CAGR of around 6.88% to 9% through 2030 due to increasing trade volumes and government initiatives like the Sagarmala Programme aimed at enhancing port connectivity and capacity.

Opportunities for Growth: JSW Infrastructure can leverage the growing demand for port services by expanding its third-party cargo operations and improving operational efficiencies.

Challenges Ahead: The company must address concerns regarding its profitability margins and manage its debt levels effectively as indicated by its rising debt-to-equity ratio.

Breakdown of in-house vs. third-party cargo.

| Cargo Type | Volume Handled | % of Total Cargo | YoY Growth |

| In-House Cargo | 63.6 MTPA | 60% | ~8% |

| Third-party cargo | 42.4 MTPA | 40% | 36% |

| Total | 106 MTPA | 100% | 15% |

In-House Cargo (Group Cargo)

Percentage of Total Cargo: Approximately 60% to 63.4% of total cargo handled is attributed to in-house operations, primarily serving JSW Steel and related entities.

Types of Cargo: The in-house cargo mainly consists of thermal coal, iron ore, and other materials necessary for the steel production process.

Third-Party Cargo

Percentage of Total Cargo: Third-party cargo has increased significantly, contributing about 36.6% to 40% of total cargo handled.

Types of Cargo: This segment includes a variety of commodities such as sugar, fertilizers, LPG, iron ore, and coal. The growth in this area indicates diversification beyond group operations.

Performance Analysis

Overall Cargo Handling: JSW Infrastructure reported a total cargo volume increase to 106 million tonnes (MT) in FY24, marking a 15% year-over-year growth. This growth is attributed to both in-house needs and expanding third-party services.

Third-Party Growth: The third-party cargo segment has grown from around 24.8% in FY21 to approximately 36.6% in FY24, reflecting a strategic shift towards enhancing external customer base and reducing dependency on group cargo.

Strategic Implications

Diversification Benefits: Increasing the share of third-party cargo reduces reliance on JSW Steel’s internal demand, which can mitigate risks associated with fluctuations in steel production or changes in internal logistics costs.

Market Positioning: As the second-largest private port operator in India, JSW Infrastructure’s ability to handle a diverse range of cargo types positions it well to capitalize on India’s growing trade and logistics needs.

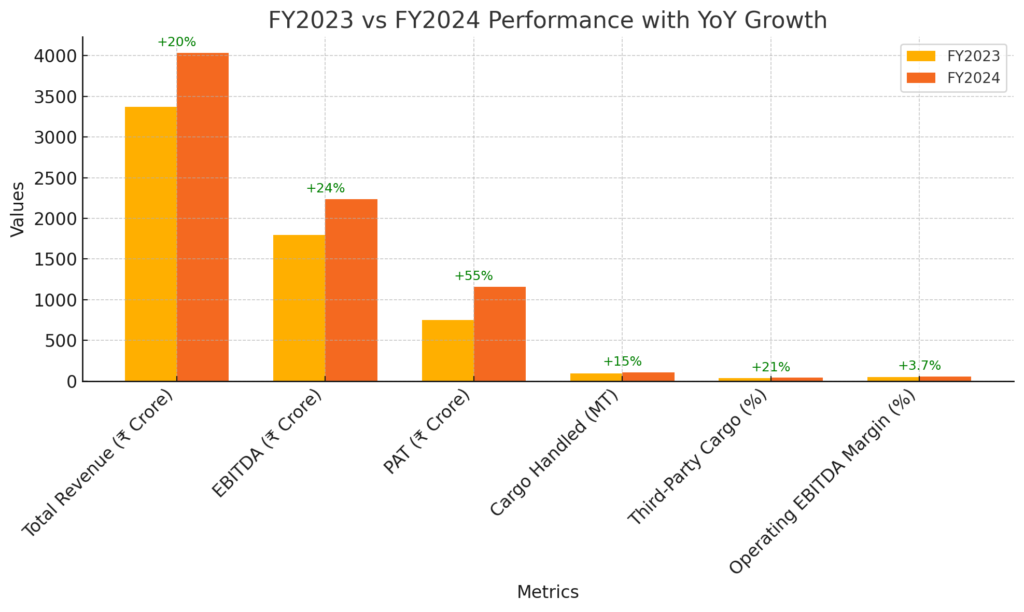

JSW Infra Year-over-year growth metrics

| Metric | FY2023 | FY2024 | YoY Growth (%) |

| Total Revenue (₹ Crore) | 3,373 | 4,032 | +20% |

| EBITDA (₹ Crore) | 1,798 | 2,234 | +24% |

| PAT (₹ Crore) | 750 | 1,161 | +55% |

| Cargo Handled (MT) | 92.8 | 106.5 | +15% |

| Third-Party Cargo (%) | 33% | 40% | +21% |

| Operating EBITDA Margin (%) | 50.7 | 55.4 | +3.7% |

| Net Debt/EBITDA Ratio | – | 0.03x |

1.Total Revenue

The total revenue increased by 20%, reaching ₹4,032 Crore in FY2024. This growth was primarily driven by a significant rise in cargo volumes handled, reflecting the company’s ability to capitalize on increasing demand within the logistics and infrastructure sectors.

2.EBITDA:

EBITDA rose by 24% to ₹2,234 Crore, indicating that the company effectively managed its costs while increasing revenue. This is a positive sign of operational efficiency and suggests that JSW Infrastructure is improving its profitability through better resource management.

3.PAT (Profit After Tax)

The net profit surged by 55%, reaching ₹1,161 Crore, which highlights the company’s strong financial performance amid rising revenues and effective cost control measures. This substantial increase in PAT is a strong indicator of the company’s overall health and operational success.

4.Cargo Handled

Cargo handling increased by 15%, totaling 106.5 million tonnes in FY2024. This growth was supported by enhanced capacity utilization at key terminals such as Paradip and Ennore, as well as an increase in third-party cargo volumes.

5.Third-Party Cargo

The share of third-party cargo grew from 33% to 40%, reflecting a strategic shift towards diversifying the customer base and reducing dependency on group cargo from JSW Steel. This diversification helps stabilize revenue streams and mitigate risks associated with fluctuations in internal demand.

6.Operating EBITDA Margin:

The operating EBITDA margin improved from 50.7% to 55.4%, indicating better cost management and operational efficiency. A higher margin suggests that the company is retaining more profit from its revenues, which is favorable for long-term sustainability.

7.Net Debt/EBITDA Ratio:

The net debt-to-EBITDA ratio stands at an impressive 0.03x, demonstrating a strong balance sheet with minimal leverage. This low ratio indicates that JSW Infrastructure is well-positioned to manage its debts effectively while pursuing growth opportunities.

Comparison with Peers

Adani Ports

Adani Ports reported a revenue growth of 28% and a PAT increase of 50%, significantly outperforming JSW Infrastructure in these metrics.

The company’s strong market position and extensive network of ports contribute to its robust performance.

Gujarat Pipavav Port

Gujarat Pipavav experienced a decline in revenue of approximately 10%, indicating challenges in its operations compared to JSW Infrastructure’s positive growth.

Despite this decline, Gujarat Pipavav has shown resilience with some recovery in recent quarters.

Is JSW Infrastructure Doing Well?

JSW Infrastructure’s performance metrics for FY2024 indicate a solid year-over-year growth trajectory across key financial indicators, particularly in PAT and EBITDA margins:

The company is effectively increasing its operational capacity while diversifying its cargo handling through third-party services.

Compared to its peers, JSW Infrastructure shows strong fundamentals despite facing competition from Adani Ports.

Overall, the company appears to be performing well within the infrastructure sector, supported by strategic initiatives that enhance profitability and operational efficiency.

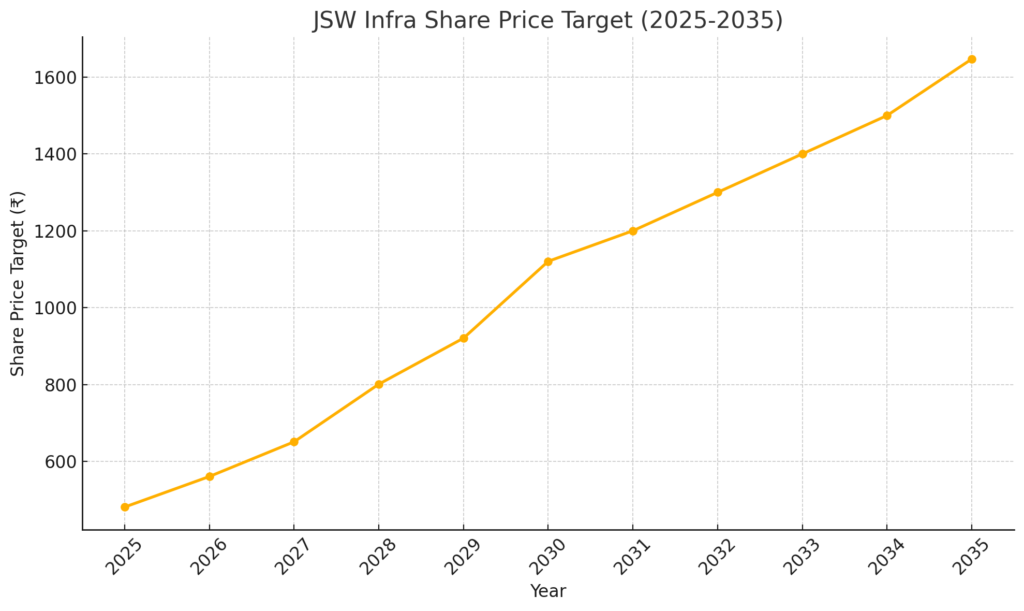

JSW Infra Share Price Target 2025-2035

| Year | JSW Infra Share Price Target |

| 2025 | ₹480.95 |

| 2026 | ₹560.45 |

| 2027 | ₹650.78 |

| 2028 | ₹800.75 |

| 2029 | ₹920.48 |

| 2030 | ₹1,120.48 |

| 2031 | ₹1,200.00 |

| 2032 | ₹1,300.00 |

| 2033 | ₹1,400.00 |

| 2034 | ₹1,500.00 |

| 2035 | ₹1,647.00 |

JSW Infra Share Price Target 2025 (₹480.95)

For 2025, the target of ₹480.95 is supported by continued market expansion and the integration of new technologies that enhance operational efficiency. As JSW Infrastructure capitalizes on favorable regulatory changes in India’s infrastructure sector, this growth is likely to attract more investments.

JSW Infra Share Price Target 2026 (₹560.45)

The price target of ₹560.45 for 2026 anticipates robust demand for port services and logistics solutions as India’s economy grows. The company’s strategic investments in smart ports and logistics are expected to yield significant returns, contributing to this upward price movement.

JSW Infra Share Price Target 2027 (₹650.78)

By 2027, the projected price of ₹650.78 reflects JSW’s ability to navigate challenges in the infrastructure sector while capitalizing on emerging opportunities. Continued investment in research and development will position the company as a leader in innovative logistics solutions.

JSW Infra Share Price Target 2028(₹800.75)

The target of ₹800.75 for 2028 indicates strong market confidence as JSW Infrastructure enhances its global presence and expands its service offerings. Growth in international markets and increased cargo handling capabilities are expected to drive this valuation.

JSW Infra Share Price Target 2029(₹920.48)

In 2029, the price target of ₹920.48 suggests sustained strong performance due to high profit margins and a focus on sustainability and innovation. Successful execution of large-scale projects will likely enhance profitability further.

JSW Infra Share Price Target 2030(₹1,120.48)

The projection of ₹1,120.48 for 2030 reflects an optimistic outlook based on anticipated continued growth in cargo volumes and operational efficiency improvements. The company’s strategic positioning within the expanding infrastructure sector supports this long-term growth narrative.

JSW Infra Share Price Target 2031(₹1,200.00)

By 2031, reaching a price of ₹1,200 indicates that JSW Infrastructure will have solidified its market position through successful project completions and enhanced service offerings across multiple sectors.

JSW Infra Share Price Target 2032(₹1,300.00)

A target of ₹1,300 for 2032 suggests that the company will benefit from a mature portfolio of services and strong demand from both domestic and international clients.

JSW Infra Share Price Target 2033 (₹1,400.00)

The projection of ₹1,400 for 2033 indicates continued robust growth driven by strategic expansions and operational efficiencies that enhance profitability across all segments.

JSW Infra Share Price Target 2034(₹1,500.00)

Finally, the target price of ₹1,500 for 2034 reflects an optimistic long-term outlook based on sustained economic growth in India and increased infrastructure spending by the government, which will likely benefit JSW Infrastructure significantly.

1.JSW Infra Historical Performance:

JSW Infrastructure has shown consistent growth in revenue and profitability over recent years, with a reported 20% revenue growth and a 55% increase in net profit in FY2024. This strong historical performance builds confidence in future projections.

2.JSW Infra Market Trends:

The Indian infrastructure sector is poised for significant growth, driven by government initiatives aimed at enhancing port facilities and logistics networks. The push for smart cities and improved trade corridors is expected to create more opportunities for companies like JSW Infrastructure.

3.JSW Infra Sectoral Growth Outlook:

The overall outlook for the infrastructure sector in India is positive, with forecasts suggesting a compound annual growth rate (CAGR) of around 6.88% to 9% through 2030. This growth is supported by increasing trade volumes, investments in infrastructure development, and favorable regulatory changes.

4.JSW Infra Strategic Investments:

JSW Infrastructure’s strategic investments in expanding its port capabilities and logistics solutions are expected to enhance its operational efficiency and market reach. The company’s focus on integrating new technologies and digital solutions will likely improve service delivery and reduce operational costs.

5.Diversification of Cargo Handling:

The increasing share of third-party cargo handling, which now constitutes about 40% of total cargo, indicates a successful diversification strategy that reduces dependency on group cargo and enhances revenue stability.

6.Government Policies and Initiatives:

Continuous support from the Indian government for infrastructure development through policies and funding will play a crucial role in driving growth for JSW Infrastructure.

6. Growth Drivers for JSW Infrastructure

JSW Infrastructure, a leading private port operator in India, is poised for significant growth driven by strategic expansion and favorable market conditions. With a current cargo handling capacity of 170 MTPA, the company aims to reach 400 MTPA by 2030 through greenfield projects and operational enhancements.

Diversification into third-party cargo and reduced reliance on JSW Group businesses strengthen revenue stability. Government initiatives like Sagarmala and rising trade volumes further boost opportunities. Additionally, JSW Infrastructure’s global presence and investments in automation and sustainability align with evolving industry trends, positioning it as a key player in India’s infrastructure growth story.

1. Expanding Port Capacities

Current Capacity: As of FY2024, JSW Infrastructure has an installed cargo handling capacity of 170 million tonnes per annum (MTPA). The company aims to scale this capacity to 400 MTPA by 2030.

Strategic Investments: The company is investing heavily in both expanding existing ports and developing new terminals. Key greenfield projects include the Jatadhar Port in Odisha, which will support JSW Steel’s upcoming steel facility.

Operational Efficiency: Improved efficiency at existing terminals has enhanced cargo handling capabilities. For instance, Jaigarh Port’s capacity utilization has seen significant improvement, contributing positively to the company’s overall operational performance.

2. Diversification into Third-Party Cargo

Growth in Third-Party Cargo: The share of third-party cargo has grown from 33% in FY2023 to 40% in FY2024, reflecting JSW Infrastructure’s strategic focus on diversifying its revenue streams beyond internal group cargo.

Stable Revenue Streams: Diversification into third-party cargo provides stable and predictable revenue streams, reducing dependency on JSW Group companies. It also positions the company to serve a broader customer base, strengthening its market presence.

Increased Demand: Rising demand for logistics services across sectors such as manufacturing and energy supports this trend. Government programs like “Make in India” and “Atmanirbhar Bharat” further drive demand for efficient cargo solutions.

3. India’s Infrastructure Development Push

Government Initiatives: The Indian government’s infrastructure programs, such as the “Sagarmala” program, aim to optimize and expand port infrastructure, significantly enhancing national capacity.

Investment Plans: The Maritime India Vision 2030 outlines a planned investment of ₹3 lakh crore to modernize and improve port facilities. As a leading player, JSW Infrastructure is well-positioned to capitalize on these developments.

Rising Cargo Throughput: India’s cargo throughput reached a record high of 1,539 million metric tonnes (MMT) in FY2024, signaling strong trade volumes. This growth creates a favorable environment for port operators like JSW Infrastructure to expand operations.

4. Global Trade Expansion

Increased Global Trade Volumes: Post-pandemic recovery in global trade has led to rising demand for efficient logistics solutions.

JSW Infrastructure, with its strategic port locations and advanced operational capabilities, is well-equipped to seize these opportunities.

Containerization Trends: The global shift towards containerized cargo handling is a major growth driver. JSW Infrastructure’s focus on enhancing its container handling capacity aligns with this trend and positions it for future growth.

Geographical Advantage: The company’s ports are strategically located on both the eastern and western coasts of India, enabling it to efficiently serve both domestic markets and international trade routes. This geographical advantage enhances competitiveness and strengthens its role in the global trade ecosystem.

Shareholding Pattern Analysis of JSW Infrastructure

The shareholding pattern of JSW Infrastructure reflects a stable and controlled ownership structure, which is generally positive for long-term growth and stability. Here’s a detailed breakdown:

1. Promoter Holding (85.61%)

A consistently high promoter holding of 85.61% across all quarters shows strong confidence and commitment from the promoters.

High promoter ownership aligns shareholder and management interests, reducing the risk of hostile takeovers.

However, SEBI mandates promoters to dilute stakes below 75% in listed entities over time, which could occur as the company grows.

2. Foreign Institutional Investors (FIIs)

FIIs increased their stake from 2.34% (Mar 2024) to 4.20% (Sep 2024).

This rise indicates growing foreign investor confidence in the company’s performance and growth prospects, which is a positive signal for future capital inflows.

3. Domestic Institutional Investors (DIIs)

DIIs’ shareholding has declined from 4.13% in Sep 2023 to 2.50% in Sep 2024.

This could signal profit-booking or sectoral reallocation by domestic funds. However, it’s not alarming, as FIIs offset this reduction with their increased participation.

5. Others

Shareholding by “Others” reduced from 3.18% (Sep 2023) to 1.36% (Sep 2024), reflecting a cleanup of non-strategic or smaller holdings.

Challenges and Risks for JSW Infrastructure

JSW Infrastructure, while positioned for growth, faces several challenges and risks that could impact its performance. Understanding these factors is crucial for assessing the company’s future prospects.

1. Regulatory Challenges

Heavy Regulation: The port and infrastructure sector in India is highly regulated, with numerous approvals required from government bodies for operations and expansions. Delays in obtaining necessary licenses and clearances can hinder project timelines and operational efficiency.

Dependence on Government Policies: JSW Infrastructure relies heavily on concessions and license agreements from government entities. Any changes in policy or regulatory frameworks could adversely affect the company’s operations and profitability.

Environmental Compliance: The company must adhere to stringent environmental regulations, which can lead to increased operational costs and delays if compliance issues arise. For instance, delays in obtaining CRZ (Coastal Regulation Zone) approvals can significantly impact project timelines.

2. Economic Slowdowns and Global Uncertainties

Impact of Economic Cycles: JSW Infrastructure’s performance is closely tied to the economic health of India and global markets. Economic slowdowns can lead to reduced cargo volumes as trade activities decline, directly affecting revenue.

Global Trade Dynamics: Geopolitical tensions, trade disputes, or pandemics can disrupt global supply chains and reduce demand for port services. For example, a slowdown in manufacturing or exports due to global uncertainties could lead to lower cargo throughput at JSW’s ports.

Inflationary Pressures: Rising inflation can increase operational costs, including labor, materials, and maintenance expenses. This could squeeze margins if the company is unable to pass these costs onto customers.

3. Increasing Competition in the Infrastructure Sector

Competitive Landscape: JSW Infrastructure faces intense competition from established players like Adani Ports, which has a larger market share and greater operational capacity (approximately 580 MTPA). This competitive pressure can impact pricing strategies and market share.

Market Saturation: As more players enter the infrastructure sector, particularly in ports and logistics, market saturation could lead to price wars, further eroding profit margins.

Innovation and Technology Adoption: Competitors may adopt advanced technologies or innovative practices that enhance efficiency or customer service. JSW must continuously invest in technology and innovation to maintain its competitive edge.

Roshan Sharma – Founder of StocksForBeginners.in

I’m Roshan Sharma, a stock market trader with 5+ years of experience. At StocksForBeginners.in, I provide expert fundamental analysis of Indian companies to help long-term investors make informed decisions. My mission is to simplify investing for beginners and share insights from my experience to guide others toward financial growth.