Projecting NIIT’s stock price for 2024 requires analyzing its financial fundamentals, growth strategy, and market dynamics.

NIIT has shown consistent revenue streams and healthy profit margins, supported by rising demand for digital learning solutions.

The company’s strong performance is bolstered by effective cost management, leading to year-over-year revenue growth.

However, macroeconomic factors such as fluctuating interest rates, inflation, and geopolitical events introduce uncertainty and can affect market sentiment.

Growth Strategy

NIIT’s expansion into new markets and strategic acquisitions have enhanced its competitive edge. The focus on digital and corporate training aligns with the increasing demand for professional upskilling.

Technological Advancements

Leveraging AI, big data, and cybersecurity enhances service quality and customer engagement. Collaborations with tech firms and academic institutions are expected to expand platform reach.

Market Position

The competitive landscape includes established players and emerging digital platforms. NIIT’s innovative offerings aim to differentiate its services and capture market share.

Risks

Macroeconomic volatility and regulatory challenges in different regions can impact growth.

While NIIT’s trajectory appears positive, continuous monitoring of industry trends and operational strategies is crucial for investors. Current investor sentiment, reflected in the September 2024 shareholding pattern, offers insights into market confidence.

Key Financial Data for NIIT Limited:

| Matric | Value |

| Current Stock Price | ₹171.09 |

| Market Cap | ₹2.5K crore |

| P/E Ratio | 55.20 |

| Dividend Yield | 0.66% |

| 52-Week High/Low | ₹183 / ₹79.50 |

Current NIIT Business Situation

Revenue Trends: NIIT recorded a decline in revenue for FY24 at ₹3,035 million, down by 11% YoY. However, the company showed strong sequential recovery, especially in Q4, indicating resilience despite industry-wide slowdowns .

Profitability: The net profit surged from ₹32 million in FY23 to ₹384 million in FY24. This significant increase highlights improved operational efficiency and better cost management .

Demerger Impact: The demerger of NIIT’s Corporate Learning Business to form NIIT Learning Systems Limited (NLSL) had a notable impact. The separation allowed NIIT to streamline its focus on digital learning and upskilling, reducing dependency on corporate training and increasing agility in responding to market trends .

Market Challenges: The company faced headwinds, particularly from the technology sector, where a hiring freeze and reduced training budgets among large tech clients led to a decline in volumes .

NIIT Share Price Target 20234-2030

| Year | Share Price Trage |

| NIIT Share Price Target 2024 | ₹196.75 |

| NIIT Share Price Target 2025 | ₹226.27 |

| NIIT Share Price Target 2026 | ₹260.21 |

| NIIT Share Price Target 2027 | ₹299.24 |

| NIIT Share Price Target 2028 | ₹344.12 |

| NIIT Share Price Target 2029 | ₹396.74 |

| NIIT Share Price Target 2030 | ₹456.25 |

1. Revenue Growth and Profitability Improvements:

Revenue Recovery: After a challenging FY23, NIIT demonstrated a significant recovery in FY24, with an improved revenue of ₹3,035 million. The company has shown strong growth momentum in the later quarters of FY24, suggesting a positive trend moving forward.

Increased Profitability: NIIT’s net profit surged from ₹32 million in FY23 to ₹384 million in FY24, a significant improvement driven by operational efficiency, cost control, and strategic pivot to high-demand segments like BFSI and advanced technology training.

Earnings Per Share (EPS): The EPS growth from ₹0.56 in FY23 to ₹2.85 in FY24 indicates strong earnings performance. Sustained EPS growth is expected as the company capitalizes on its streamlined focus post-demerger.

2. Strategic Initiatives and Market Positioning:

Focus on High-Growth Sectors: NIIT has pivoted towards high-growth segments such as:

BFSI (Banking, Financial Services, and Insurance): Training over 32,000 professionals in collaboration with major banks (ICICI, Axis, HDFC) indicates a strong foothold in this sector.

Generative AI Integration: The inclusion of Generative AI in training programs for tech professionals and collaboration with top-tier IT firms highlights the company’s forward-looking strategy.

Expansion of Digital Learning Solutions: The robust digital learning platform (NIIT Digital) positions the company to scale rapidly, catering to both corporate and individual learners, enhancing its market reach and revenue potential.

3. Industry Outlook and Growth Drivers:

Rising Demand for Upskilling and Reskilling: The increasing need for digital transformation and advanced technology skills in sectors like Fintech, HealthTech, and EdTech presents a significant growth opportunity for NIIT’s training programs.

Favorable Demographics in India: With a young population and growing enrolments in higher education, India offers a substantial market for talent development services. The Gross Enrolment Ratio (GER) is expected to grow from 28.4% to 50% by 2034-35, further driving demand for professional training.

Global Expansion: NIIT’s strategic partnerships with Global System Integrators (GSIs) and Global Capability Centres (GCCs) enable the company to tap into international markets, diversifying its revenue streams and reducing dependency on the domestic market.

4. Financial Health and Valuation:

Improved Balance Sheet: Post-demerger, the streamlined focus on digital learning has resulted in better financial health and reduced debt levels, positioning the company for sustained growth.

Valuation Metrics: NIIT’s current P/E ratio of 52.65 is significantly higher than the industry average (20-30), reflecting the market’s optimism about future growth prospects. The high valuation is justified by the company’s strong earnings recovery, strategic focus on high-demand sectors, and expansion in digital learning offerings.

Future Growth Potential:

Integration of New Technologies: NIIT’s focus on integrating cutting-edge technologies like AI, Machine Learning, and Data Science into its training programs aligns well with industry trends and ensures its offerings remain relevant.

Expansion in the Corporate Learning Market: The demerger has allowed NIIT to concentrate more on individual and digital learning, while its subsidiary, NIIT Learning Systems Limited, focuses on corporate learning. This separation creates a clear pathway for growth in both segments.

Increasing Demand for Tech Skills: With rapid digitalization across industries, the demand for tech skills is expected to remain strong. NIIT’s advanced technology training programs cater directly to this need, positioning it well for future growth.

Peer Comparison Analysis of NIIT

| Matric | NIIT | Industry |

| Current Market Price | ₹189.83 | ₹104.17 |

| P/E Ratio | 55.20 | 45.48 |

| Market Cap | ₹2,571 Cr | ₹415.63 |

| Dividend Yield(%) | 0.66 | 0.33 |

| Net Profit (Qtr ₹Cr) | 12.54 | 2.54 |

| Quarterly Profit Variation(%) | 21.63% | -0.5% |

| Quarterly Sale (₹Cr) | 90.71 | 74.45 |

| Quarterly Sales Variation(%) | 11.42% | -0.5% |

| ROCE(%) | 4.64 | 14.53 |

1. Valuation and Market Position:

Premium Valuation (P/E Ratio of 55.20):

NIIT’s P/E ratio is significantly higher than the industry median of 45.48, indicating that the stock is priced at a premium. This could imply that investors have strong growth expectations for NIIT due to its strategic shift towards digital learning and integration of advanced technologies like Generative AI.

However, a high P/E ratio can also suggest overvaluation, making it a riskier investment if the company fails to meet growth expectations.

2. Financial Performance:

Strong Net Profit and Sales Growth:

NIIT’s quarterly net profit of ₹12.14 crore is substantially higher than its peers, demonstrating better operational efficiency.

The positive quarterly sales growth (11.42%) compared to a negative industry trend (-0.5%) reflects NIIT’s ability to capture market demand effectively, even in challenging industry conditions.

3. Return on Capital Employed (ROCE):

Lower ROCE (4.64%):

NIIT’s ROCE is significantly below the industry median of 14.53%. This suggests the company is not utilizing its capital as efficiently as its competitors, which could impact long-term profitability.

The low ROCE could be due to the recent strategic realignment post-demerger, where the company might be reinvesting heavily in new projects and technologies, affecting immediate returns.

4. Dividend Policy:

Low Dividend Yield (0.66%):

The dividend yield is lower than the average, indicating limited returns through dividends. This suggests that NIIT is focusing more on reinvesting profits back into the business rather than distributing them to shareholders, aligning with its strategy of pursuing long-term growth.

5. Competitive Position:

Market Leadership and Strategic Focus:

With a market cap of ₹2,571 crore, NIIT stands out as one of the largest players in its industry segment, showing strong brand recognition and investor confidence.

The company’s pivot towards digital transformation, focus on BFSI sector expansion, and adoption of advanced technology training solutions position it well for future growth. Partnerships with major banks and IT firms also strengthen its market presence.

Pros of Investing in NIIT:

1.Strong Market Position: The largest market cap among peers indicates a dominant industry presence and strong brand value.

2.Positive Sales and Profit Growth: Consistently higher sales and profit growth compared to competitors reflect robust business performance.

3.Strategic Initiatives: Focus on AI-driven learning, digital transformation, and strong BFSI sector expansion offer significant growth potential in high-demand areas.

4. Reinvestment for Growth: Lower dividend payout suggests a focus on reinvestment, which could drive substantial long-term growth.

Cons of Investing in NIIT:

1.High Valuation Risk: The elevated P/E ratio indicates a premium valuation, making it a riskier investment if growth expectations are not met.

2.Low ROCE: Inefficient use of capital, as indicated by a lower ROCE, could affect long-term profitability and return on investment.

3.Industry Headwinds: The broader challenges in the education and IT training sector, including reduced corporate training budgets, could impact revenue stability.

NIIT Share Analysis of Profit & Loss Statement (2013-2024)

Sales Growth

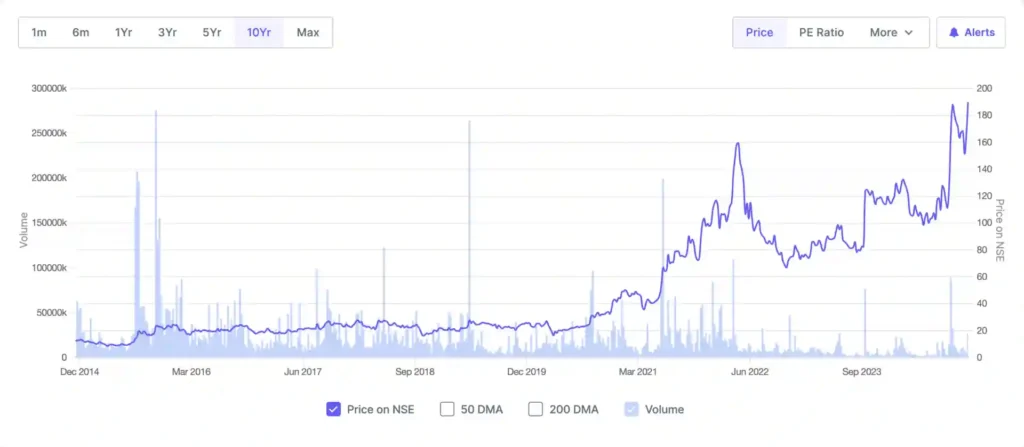

The sales figures show fluctuations over the years, with significant declines in recent years (2022-2024).

From FY2020 to FY2024, sales dropped sharply, particularly in FY2023 (₹251 crore) before recovering slightly in FY2024 (₹341 crore).

Long-term Trend:

The compounded sales growth over the last 10 years is negative at -11%, indicating a declining trend in overall revenue.

Operating Profit and Margins

The Operating Profit Margin (OPM) has been inconsistent, peaking at 17% in FY2021 but turning negative in FY2023 (-1%).

The margins improved slightly in FY2024, but the OPM remains at a low 0%, indicating challenges in maintaining profitability.

Other Income:

The company reported a significant increase in other income in FY2021 (₹1,408 crore), which has been a major contributor to overall profit in certain years.

This income has been highly variable, showing the company’s dependence on non-operational income sources.

Profit Before Tax (PBT):

NIIT recorded substantial profits in FY2020 and FY2021, reaching a PBT of ₹1,383 crore in FY2021.

However, there was a steep decline in FY2023 (₹13 crore) followed by a slight recovery in FY2024 (₹45 crore), indicating financial instability in recent years.

Net Profit and EPS:

Net Profit fluctuated significantly, with a major peak in FY2021 (₹1,327 crore) due to high other income.

The company reported losses in certain years (e.g., FY2015 with a net loss of ₹140 crore) and saw a sharp decline in FY2023 (₹8 crore).

EPS (Earnings Per Share) followed a similar trend, with a sharp increase in FY2021 (₹93.81) but dropping to ₹0.24 in FY2023 and a slight improvement to ₹2.84 in FY2024.

Dividend Payout:

Dividend payouts have been inconsistent, with no dividends declared during some years (e.g., FY2016-2019). However, there was a high payout in FY2023 (212%), signaling a potential attempt to maintain shareholder value despite low profits.

Compounded Growth Analysis:

Compounded Sales Growth:

| 10 Years | -11% |

| 5 Years | -19% |

| 3 Years | -32% |

This indicates a long-term decline in sales, especially in recent years.

Compounded Profit Growth:

| 10 Years | 13% |

| 5 Years | -15% |

| 3 Years | -29% |

The profit growth shows significant volatility, with short-term declines despite positive long-term averages.

Stock Price CAGR:

| 10 Years | 31% |

| 5 Years | 50% |

| 3 Years | 30% |

The stock price growth suggests strong market performance relative to financial results, possibly driven by investor optimism or non-operational gains.

Return on Equity (ROE):

The ROE has been relatively low, averaging around 6-7% over the long term, with a decline in the last year (4% in FY2024).

This indicates challenges in generating high returns on shareholder equity.

Past Performance (2013-2024):

NIIT Limited has experienced significant volatility in its financial performance over the past decade. Key challenges include fluctuating revenue, inconsistent operating margins, and a heavy reliance on other income for profitability.

The demerger of the Corporate Learning Business and external market challenges (e.g., hiring freezes in the tech sector) have impacted the company’s core operations, particularly in recent years.

Future Prospects of NIIT Share Price

1.Strategic Shifts and New Initiatives:

The focus on digital learning, integration of AI-driven solutions, and expansion in the BFSI sector are positive steps towards long-term growth.

New leadership and strategic shifts towards high-demand skills (e.g., Generative AI, Data Science) could stabilize core operations and drive future revenue growth.

2.Challenges to Address:

The company must address its declining sales trend and improve operational efficiency to boost operating margins.

Sustaining profitability without relying heavily on other income will be crucial for long-term financial health.

3.Growth Potential:

With the increasing demand for digital skills and reskilling in India’s growing tech sector, NIIT is well-positioned to capitalize on these trends.

The company’s focus on expanding partnerships with major banks and tech firms is expected to enhance its client base and revenue streams.

Shareholding Pattern

Promoter Holding Increase:

Promoter holding has steadily increased from 35.08% in Dec 2021 to 37.25% in Sep 2024. This indicates strong confidence from the promoters, a positive sign for potential investors as it suggests they believe in the company’s growth prospects and are willing to increase their stake.

Decline in Foreign Institutional Investors (FII) Holdings:

FII holdings have significantly decreased from 22.81% in Dec 2021 to 13.58% in Sep 2024. This reduction may reflect concerns from foreign investors about the company’s performance or broader macroeconomic factors affecting foreign investment in Indian equities. However, it also provides an opportunity for local investors to accumulate shares at potentially lower valuations.

Stable Domestic Institutional Investors (DII) Holdings:

DII holdings have remained relatively stable, fluctuating around 12-13%. The consistent interest from domestic institutions indicates a balanced outlook on the company’s performance and potential recovery in the long term.

Increase in Public Shareholding:

Public shareholding has increased from 30.43% in Dec 2021 to 37.64% in Sep 2024. This suggests rising interest among retail investors, possibly driven by the company’s focus on digital learning and new technology integration.

The increase in promoter shareholding and strong public interest are positive signals, suggesting confidence in NIIT’s long-term strategy. However, the decline in FII holdings is a concern that may reflect market uncertainties. Overall, for long-term investors, NIIT could be a good investment, particularly given its strategic initiatives and focus on high-growth sectors.

Conclusion

I believe NIIT has strong potential for long-term growth, especially given its strategic focus on high-demand areas like digital learning, AI-driven training, and BFSI sector partnerships.

However, the current high valuation and lower ROCE are concerns that should not be overlooked. Investors need to be cautious and consider the risk of overvaluation.

A potential strategy could be to wait for a better entry point if the stock price corrects, or to invest with a long-term horizon, anticipating strong growth from its new initiatives.

In conclusion, NIIT appears to be a promising investment for long-term growth-oriented investors, particularly those looking to capitalize on the digital transformation in the education and training sector.

However, it is important to monitor the company’s ability to improve capital efficiency (ROCE) and meet high growth expectations to justify its premium valuation.

Roshan Sharma – Founder of StocksForBeginners.in

I’m Roshan Sharma, a stock market trader with 5+ years of experience. At StocksForBeginners.in, I provide expert fundamental analysis of Indian companies to help long-term investors make informed decisions. My mission is to simplify investing for beginners and share insights from my experience to guide others toward financial growth.