Tata Steel: A Global Steel Industry Leader

Founded in 1907 as Asia’s first private integrated steel company, Tata Steel has grown into a global powerhouse with a 35-million-tonne annual crude steel capacity. Based in Mumbai, the company maintains operations in 26 countries and serves customers in over 50 nations, with major facilities in India, the Netherlands, and the UK.

The company’s production capacity stands at 21.6 million tonnes in India and 12.1 million tonnes in Europe. A landmark achievement was its acquisition of the Corus Group in 2007, significantly expanding its global footprint.

The company manages end-to-end operations from mining to finished products and is recognized as one of India’s top manufacturing employers.

Tata Steel’s impact on India’s infrastructure is substantial, contributing to 40 major airports, most metro rail networks, and two-thirds of the country’s flyovers and bridges.

The company also supplies materials for power plants, transmission lines, and sports facilities. In FY 2023, it achieved a consolidated turnover of $31 billion, offering a diverse range of products including automotive components, industrial products, and specialized steel solutions.

For investors, analyzing Tata Steel’s share price trends from 2025 to 2035 is crucial for strategic planning.

The company’s future growth potential is supported by its global operations, infrastructure contributions, and proven track record. Key factors influencing its outlook include global steel demand, sectoral growth trends, and broader economic conditions.

Understanding these elements helps investors make informed decisions about timing their investments and achieving long-term financial objectives.

Company Background

Founded in 1907 by Sir Jamsetji Tata, Tata Steel has been a beacon of innovation and progress in the steel industry. As Asia’s first integrated private steel producer and the developer of India’s first industrial city, Jamshedpur, the company has made significant contributions to both national and global industrial landscapes.

A Global Presence That Inspires Collaboration

Tata Steel’s operations span 26 countries across five continents, with a presence in over 50 countries, creating opportunities for collaboration and shared growth worldwide. With an inclusive and diverse workforce of 78,000 to 80,500 employees, the company stands as a model for empowering professionals from all walks of life.

Key Operational Regions:

- India: 21.6 million tonnes annual steel capacity

- Europe: 12 million tonnes annual steel capacity

- South-East Asia: Active in Thailand, Singapore, and China

Significant Milestones Along the Way

Tata Steel’s journey has been marked by strategic growth and meaningful partnerships:

- 2007: Acquired Corus Group, strengthening its European presence.

- 2015: Took a majority stake in Thailand-based Millennium Steel, broadening its South-East Asian operations.

- 2018: Acquired Bhushan Power and Steel, expanding its capacity in India and creating local economic opportunities.

Products That Serve Diverse Needs

Tata Steel’s comprehensive product portfolio addresses the needs of a wide range of industries, ensuring accessibility and utility for all:

- Automotive and Special Products

- Industrial Products

- Branded Products and Retail

Services and Solutions

From hot-rolled and cold-rolled steel to galvanized and specialized solutions, Tata Steel supports industries such as automotive, construction, packaging, and engineering.

Financial Strength and Recognition

- Turnover: INR 2,29,171 crore (US$31 billion) in FY 2023-24

- Recognized as one of India’s Best Workplaces in Manufacturing, reflecting its commitment to creating an inclusive and empowering work environment.

Driving Progress Through Innovation and Sustainability

Tata Steel strives to make the world a better place through:

- Sustainability initiatives that reduce environmental impact and promote clean energy solutions.

- Innovative technologies that enhance efficiency and product quality.

- Inclusive growth, fostering opportunities for individuals, communities, and industries.

Tata Steel’s vision is to be a global benchmark, creating value for everyone it touches and contributing to a sustainable future for all. Together, it builds the steel that builds the world.

Current Financial Performance

| Market Cap | ₹1,62,635 Cr |

| Revenue | ₹53,904.71 crore |

| Current Price | ₹130 |

| High / Low | ₹185 / 123 |

| Stock P/E | 53.4 |

| Book Value | ₹ 72.2 |

| Dividend Yield | 2.76 % |

| ROCE | 7.02 % |

| ROE | 6.55 % |

| Face Value | ₹ 1.00 |

| Price to book value | 1.80 |

| Debt to equity | 1.10 |

| EPS | ₹ 2.34 |

| Profit growth | 4,919 % |

| Net Profit | ₹833.45 crore |

| EBITDA | ₹6,141 crore |

| Expenses | ₹52,331.58 crore |

Tata Steel Share price trends over the last 5 years

| Year | 2020 | 2021 | 2022 | 2023 | 2024 |

| Opening Price | ₹26.57 | ₹46.90 | ₹106.94 | ₹136.84 | ₹138.05 |

| Closing Price | ₹46.90 | ₹106.94 | ₹136.84 | ₹138.05 | ₹126.53 |

| Annual Change | +76.5% | +128.0% | +28.0% | +0.9% | -8.3% |

| High | ₹64.75 | ₹110.21 | ₹138.46 | ₹180.95 | ₹139.72 |

| Low | ₹24.60 | ₹41.59 | ₹96.40 | ₹125.67 | ₹122.62 |

Tata Steel Share Performance 2020

Despite the global economic downturn due to the COVID-19 pandemic, Tata Steel’s share price demonstrated resilience, closing the year with a significant gain.

- Steel Demand Recovery: After an initial sharp decline in Q1 2020, infrastructure spending and manufacturing activity resumed in Q3, especially in India and China, driving steel demand.

- Cost Management: Tata Steel’s integrated operations, including captive iron ore mines, helped mitigate the impact of rising raw material costs.

- Global Steel Prices: Prices recovered globally, with hot-rolled coil (HRC) prices rising sharply in Q2 2020, boosting profitability.

- Investor Sentiment: Positive quarterly results in Q2, with improved margins and reduced debt, supported the stock’s rally.

Tata Steel Share Performance 2021

The company experienced substantial growth, with its share price more than doubling, reflecting strong recovery and performance.

- Global Price Surge: A steel supercycle emerged as global demand surged due to economic recovery and supply chain disruptions, with steel prices reaching multi-year highs.

- Capacity Expansion: Tata Steel increased production capacity through acquisitions (e.g., Bhushan Steel) and ramped-up operations at Kalinganagar.

- Indian Infrastructure Push: Government spending on housing, roads, and railways drove domestic demand.

- Record Profits: Tata Steel reported record EBITDA of ₹35,000 crore, a 71% YoY increase.

- Debt Reduction: The company reduced net debt by ₹20,000 crore, improving investor confidence.

Tata Steel Share Performance 2022

Continued positive momentum with steady growth in share value.

- Operational Excellence: Tata Steel achieved record deliveries of 30 MTPA, supported by its acquisitions and operational efficiencies.

- Sustainability Initiatives: Investments in green technologies aligned with global ESG trends boosted investor interest.

- Geopolitical Impact: The Russia-Ukraine conflict created uncertainty, but rising steel demand in India and China provided a buffer.

- Profitability: Sustained high steel prices and operational efficiencies supported EBITDA margins above 30%.

Tata Steel Share Performance 2023

The share price reached an all-time high in mid-2023 but faced corrections, ending the year with a modest gain.

- Strong Q1 Performance: The company benefited from robust domestic demand, with India’s infrastructure projects driving sales of flat and long steel.

- Peak Price Levels: Steel prices peaked due to supply constraints, boosting Tata Steel’s stock to a record high.

- Corrections in Q2: Rising interest rates and profit-booking by investors caused the stock to correct.

- ESG Appeal: Progress toward Net Zero emissions by 2045 attracted long-term institutional investors.

Tata Steel Share Performance 2024

The stock experienced a slight decline, influenced by market volatility and global economic factors.

- Global Slowdown: Economic uncertainty in major markets, coupled with slowing growth in Europe, affected global steel demand.

- Rising Costs: Energy and raw material costs remained volatile, squeezing margins.

- Strategic Focus: Tata Steel’s focus on transitioning to low-carbon steel and restructuring European operations incurred short-term costs but positioned the company for long-term growth.

- Mixed Sentiment: While the company’s fundamentals remained strong, global macroeconomic headwinds led to cautious investor sentiment.

Tata Steel: A Global Leader in Steel Production

Tata Steel stands as one of the world’s leading steel manufacturers, renowned for its innovation, operational excellence, and commitment to sustainability. With a rich legacy and a global footprint, the company has consistently demonstrated its ability to deliver high-quality steel solutions while maintaining a strong focus on environmental and social responsibility.

Global Industry Ranking

Tata Steel is a prominent player in the global steel industry, holding a strong position among the top steel manufacturers worldwide. Key highlights include:

- An annual crude steel production capacity of 35 million tonnes per annum.

- Ranked 29.50 in global steel production by the World Steel Association.

- Positioned 56th globally in steel production prior to the Corus acquisition, marking its journey of remarkable growth.

Competitive Strengths

Tata Steel’s competitive edge lies in its diversified operations and market presence:

- Among the most geographically diversified steel producers, with operations across 26 countries spanning five continents.

- A strong presence in key markets, including India, the Netherlands, and the United Kingdom.

- Consolidated turnover of US$27.7 billion in FY 2024, reflecting its robust financial performance.

Unique Competitive Advantages

Tata Steel enjoys several unique advantages that solidify its leadership position:

- One of only three Indian steel companies with captive iron-ore mines, ensuring a consistent and cost-effective supply of raw materials.

- A significant price advantage due to integrated mining capabilities.

- The largest steel producer in India by domestic production.

- A highly skilled workforce of over 78,000 professionals, driving innovation and operational efficiency.

Recognition and Sustainability

Tata Steel is deeply committed to sustainability and excellence in workplace culture:

- Included in the Dow Jones Sustainability Emerging Markets Index since 2012, highlighting its focus on environmental and social governance.

- Consistently ranked among the top 10 steel companies in sustainability assessments.

- Recognized as a Great Place to Work-Certified organization, underlining its employee-friendly practices.

- An ambitious goal to achieve Net Zero carbon emissions by 2045, showcasing its leadership in sustainable steel production.

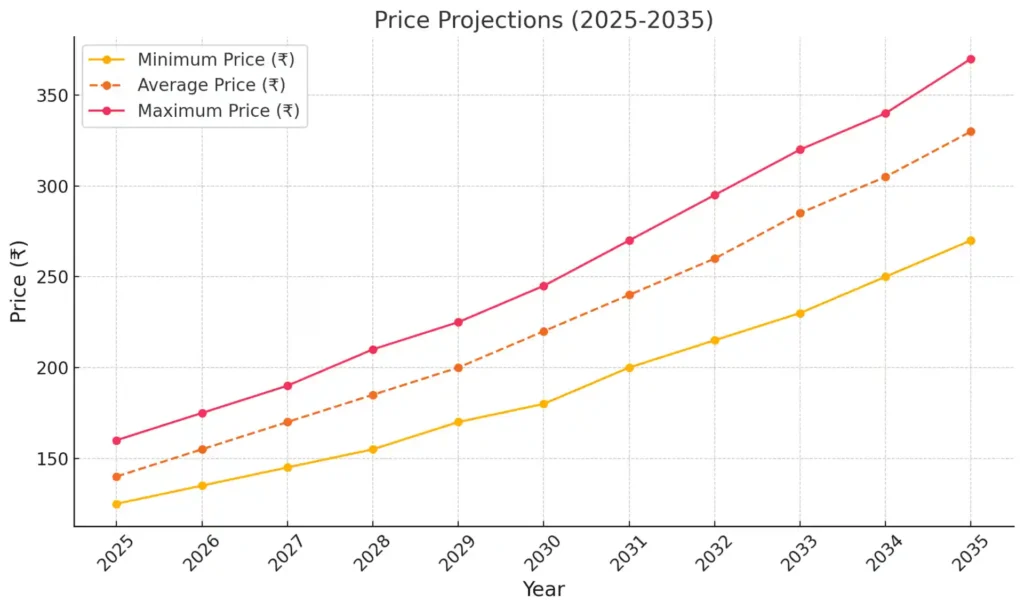

Tata Steel Share Price Target 2025-2035

| Year | Minimum Price | Average Price | Maximum Price |

| Tata Steel Share Price Target 2025 | 125 | 140 | 160 |

| Tata Steel Share Price Target 2026 | 135 | 155 | 175 |

| Tata Steel Share Price Target 2027 | 145 | 170 | 190 |

| Tata Steel Share Price Target 2028 | 155 | 185 | 210 |

| Tata Steel Share Price Target 2029 | 170 | 200 | 225 |

| Tata Steel Share Price Target 2030 | 180 | 220 | 245 |

| Tata Steel Share Price Target 2031 | 200 | 240 | 270 |

| Tata Steel Share Price Target 2032 | 215 | 260 | 295 |

| Tata Steel Share Price Target 2033 | 230 | 285 | 320 |

| Tata Steel Share Price Target 2034 | 250 | 305 | 340 |

| Tata Steel Share Price Target 2035 | 270 | 330 | 370 |

Tata Steel Share Price Target 2025

Forecast Price Range: ₹125–₹160, Average: ₹140

- Production Capacity: Expected to exceed 23 MTPA in India, leveraging its integrated operations .

- Revenue Growth: Anticipated growth of ~10%, reaching ₹2.6 lakh crore due to stable steel demand in India and Southeast Asia.

- Sustainability Initiatives: Early-stage benefits from green steel investments will attract ESG-focused investors.

Tata Steel will stabilize its earnings as global steel prices recover from 2024 levels, supported by India’s infrastructure development and cost efficiencies. However, challenges like energy price volatility and slower European recovery may limit upside.

Tata Steel Share Price Target 2026

Forecast Price Range: ₹135–₹175, Average: ₹155

- Global Recovery: Economic improvement in Europe and Southeast Asia will boost exports, with export share increasing from 13% to ~16%.

- Capacity Expansion: Additional Indian capacity coming online, contributing to higher production volumes.

- Debt Reduction: Focused debt repayment strategy will strengthen financials .

Improved capacity utilization and rising export demand will drive revenues and profitability. Tata Steel’s focus on value-added products will further enhance margins.

Tata Steel Share Price Target 2027

Forecast Price Range: ₹145–₹190, Average: ₹170

- Value-Added Steel: Contributing 20%+ to overall revenue, driven by demand from automotive and construction sectors.

- Steel Prices Stabilization: Global prices expected to stabilize at ~$750/ton, supporting healthy realizations.

Tata Steel’s investments in high-margin products and the recovery in global steel markets will support this price range.

Tata Steel Share Price Target 2028

Forecast Price Range: ₹155–₹210, Average: ₹185

- Green Steel Premiums: Green steel contributing up to 10% of total revenue (~₹30,000 crore).

- India’s Infrastructure Boom: Sustained growth in construction and industrial activity will drive domestic steel demand.

Higher pricing power from eco-friendly products and strong domestic demand will help Tata Steel achieve robust revenue growth.

Tata Steel Share Price Target 2029

Forecast Price Range: ₹170–₹225, Average: ₹200

- Production: Expected global deliveries to exceed 30 MTPA.

- Cost Efficiency: Savings from modernized facilities and captive iron ore mines will support EBITDA margins of ~28%.

Enhanced global competitiveness and strong demand from emerging markets will drive the stock higher.

Tata Steel Share Price Target 2030

Forecast Price Range: ₹180–₹245, Average: ₹220

- Doubling Capacity: India’s production capacity surpassing 40 MTPA will result in record revenues.

- Green Steel Advantage: Growing demand for sustainable products in Europe and the U.S.

Tata Steel will reach new heights as capacity expansion projects mature and decarbonization efforts pay off.

Tata Steel Share Price Target 2031

Forecast Price Range: ₹200–₹270, Average: ₹240

- Specialty Steel Growth: Specialty products will contribute 25%+ of revenues.

- Global Steel Demand: Increasing use in renewable energy, EVs, and construction.

Tata Steel’s leadership in value-added products and global market positioning will drive consistent stock growth.

Tata Steel Share Price Target 2032

Forecast Price Range: ₹215–₹295, Average: ₹260

- Revenue Growth: Approaching ₹4.5 lakh crore, driven by capacity utilization and premium pricing.

- Innovation: Increased R&D (~₹2,000 crore annually) for advanced materials.

A diversified revenue mix and leadership in green steel will ensure robust financial performance.

Tata Steel Share Price Target 2033

Forecast Price Range: ₹230–₹320, Average: ₹285

- Global Ranking: Top 5 steel producers globally, with ESG compliance as a major competitive advantage.

- Net Zero Progress: Significant milestones in reducing carbon emissions.

Tata Steel will command premium valuations as a sustainability leader with strong operational metrics.

Tata Steel Share Price Target 2034

Forecast Price Range: ₹250–₹340, Average: ₹305

- India’s Steel Demand: Exceeding 200 MTPA, with Tata Steel holding ~20% market share.

- Export Revenue Share: Likely contributing 18–20% of total revenue.

Tata Steel’s position as a dominant player in India and a top global exporter will support steady price growth.

Tata Steel Share Price Target 2035

Forecast Price Range: ₹270–₹370, Average: ₹330

- Revenue: Likely exceeding ₹5.5 lakh crore, supported by 45 MTPA capacity globally.

- Profitability: Sustained EBITDA margins of ~30%.

Full realization of Tata Steel’s strategic capacity expansion and green steel initiatives will establish it as a market leader, driving strong share price performance.

Roshan Sharma – Founder of StocksForBeginners.in

I’m Roshan Sharma, a stock market trader with 5+ years of experience. At StocksForBeginners.in, I provide expert fundamental analysis of Indian companies to help long-term investors make informed decisions. My mission is to simplify investing for beginners and share insights from my experience to guide others toward financial growth.